Ahead of the Curve - August '24

After a short [two year] hiatus, the official Curve news site is back! In this issue we recap all of July 2024's major Curve updates! Already feels like ancient history with August looking to be... interesting.

crvUSD

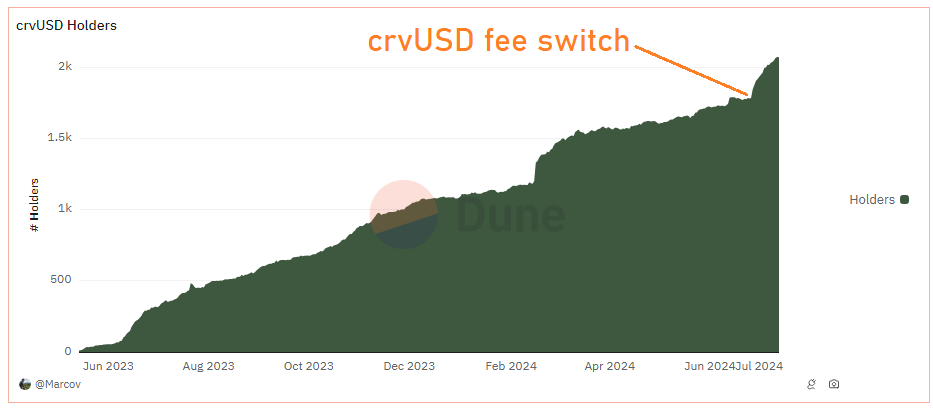

July became an historic month for $crvUSD, marking the first month Curve fully used $crvUSD as the veCRV reward token instead of 3CRV.

Following a successful governance vote, the $crvUSD feeless FlashLender contract is now live.

crvusd feeless flashloan liquidity source on ethereum: https://t.co/DWgKyi8KZt

— fiddy (@fiddyresearch) August 1, 2024

please enjoy and keep our liquidity pools healthy!

Users may now take out flash loans for $crvUSD. More information on the process is available in the documentation.

The Llama Risk team has released several useful resources related to $crvUSD, including a chain-agnostic agent-based simulation market in collaboration with Xenophon Labs and a regulatory brief on Peg Keeper coins based on a Bank of International Settlements document reviewing global stablecoin policies.

As part of our engagement with @defidotmoney we are building on work by @XenophonLabs to develop a chain-agnostic ABS model for $crvUSD.

— LlamaRisk (@LlamaRisk) July 31, 2024

This tool will improve risk optimization for @CurveFinance crvUSD, LlamaLend, and our friendly fork frens! https://t.co/owHTodhFDR pic.twitter.com/mBeqo63lVF

We've published a regulatory brief on @CurveFinance PegKeeper stablecoins based on an overview of stablecoins policy implementations from the Bank of International Settlements.

— LlamaRisk (@LlamaRisk) July 17, 2024

The brief here and summary below:https://t.co/nYVPriN9ye

1/7 pic.twitter.com/HJxyUt3oXC

Despite a volatile month in the markets, the LLAMMA liquidations protections appear strong, per the Chaos Labs risk dashboard:

Does LLAMMA protect from liquidations? Here are the stats from Chaos Labs for https://t.co/EjL8SImCsN. Not too many liquidations recently, it appears (soft-liquidation was working well)https://t.co/pmuVRlSGRc pic.twitter.com/3CQCxcEj9p

— Curve Finance (@CurveFinance) July 5, 2024

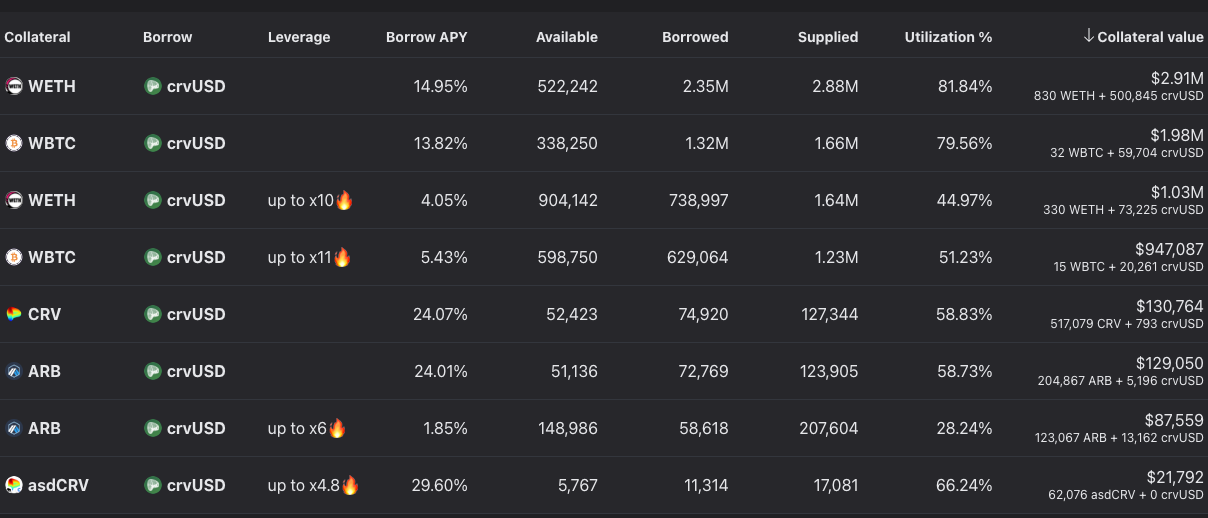

Llama Lend

Search and sorting is now available in @llamalend pic.twitter.com/SCoIBJghTK

— Curve Finance (@CurveFinance) August 2, 2024

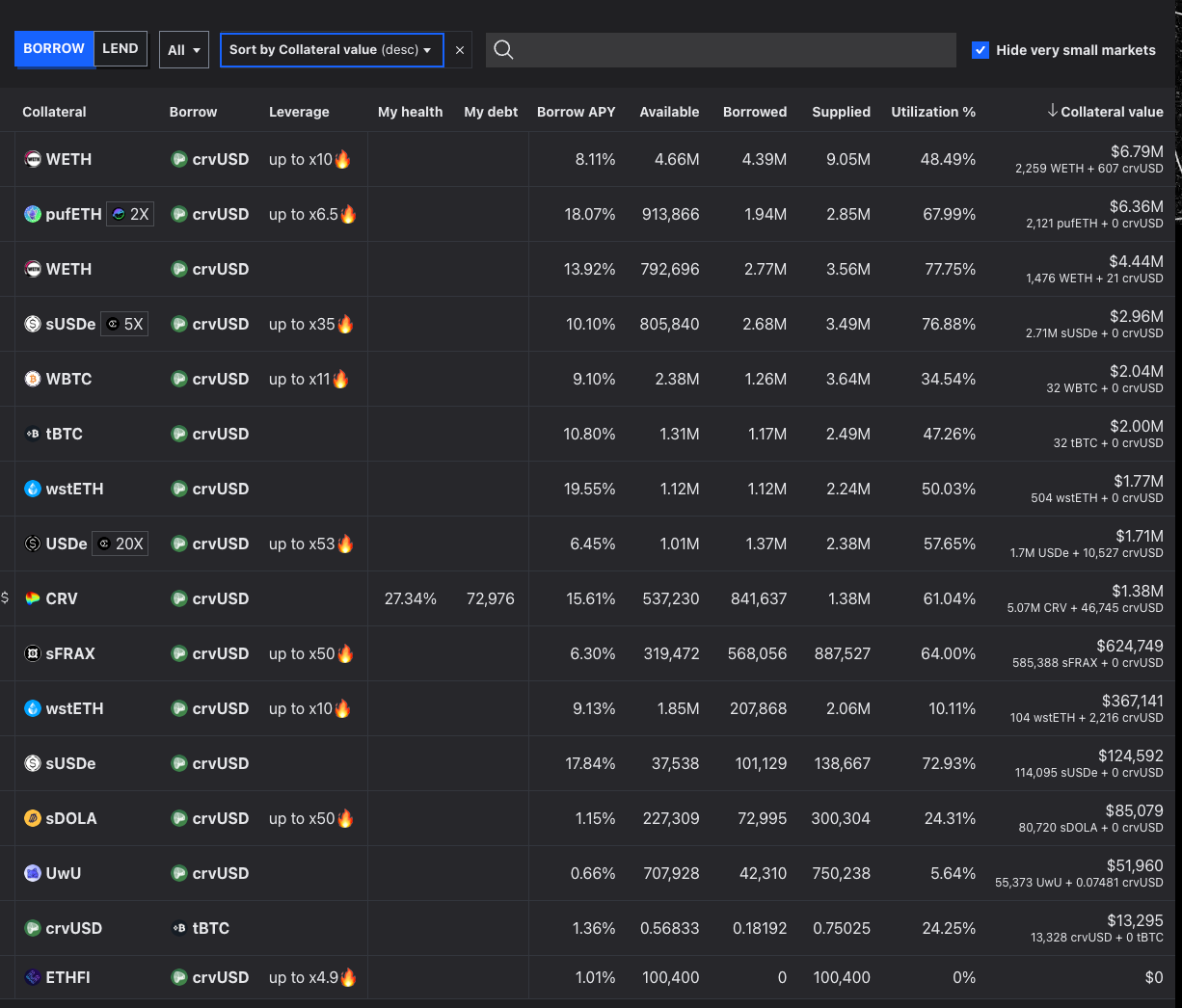

Sorting has arrived on Llama Lend. More than just sorting, the major UI update also compacts the interface to better show off all the active markets.

This condensed display is useful, as so many interesting markets have been deployed on Llama Lend. One such notable market involves the very first market using a Curve LP tokens, this time in the form of a Usual Money pool that earns points instead of $CRV.

The era of borrowing against @CurveFinance LP Positions on Llama Lend is arriving, starting with @usualmoney's $USD0/$USD0++ (earns pills, not $CRV)

— Curve Llama Lend (@llamalend) July 30, 2024

h/t @StormlightTower pic.twitter.com/q0paLyFR2p

A variety of yield-bearing stablecoin pools have also been added, notably offering up to 53x leveraged trading.

💥 BA-BOOM! 💥 sDOLA just landed on Llamalend from @CurveFinance! 🚀 Now borrow $crvUSD against sDOLA, the 100% organic yield bearing stablecoin from Inverse, with up to 50x leverage!! 👀 pic.twitter.com/tofhkDfrIq

— Inverse (@InverseFinance) July 17, 2024

Which is not to neglect the several launches on Arbitrum

Including $asdCRV!

4.8x levered $asdCRV pic.twitter.com/d3kPs8rYId

— Curve Llama Lend (@llamalend) July 9, 2024

To learn more about how to interact with Llama Lend programmatically to launch markets and perform liquidations, refer to the Curve Titanoboa Llama Lend tutorial

🐍 Curve @LlamaLend Titanoboa Tutorial 🐍

— crv.mktcap.eth (@CurveCap) July 16, 2024

Lesson 4: Blueprint

Our final prerequisite lesson before liqs/arb trading, we create a test loan and seed a healthy liquidity pool for liquidations.

Key boa concepts include re-using implementation ABIs and the prank function

🧵1/5👇 pic.twitter.com/d0lU9ts83v

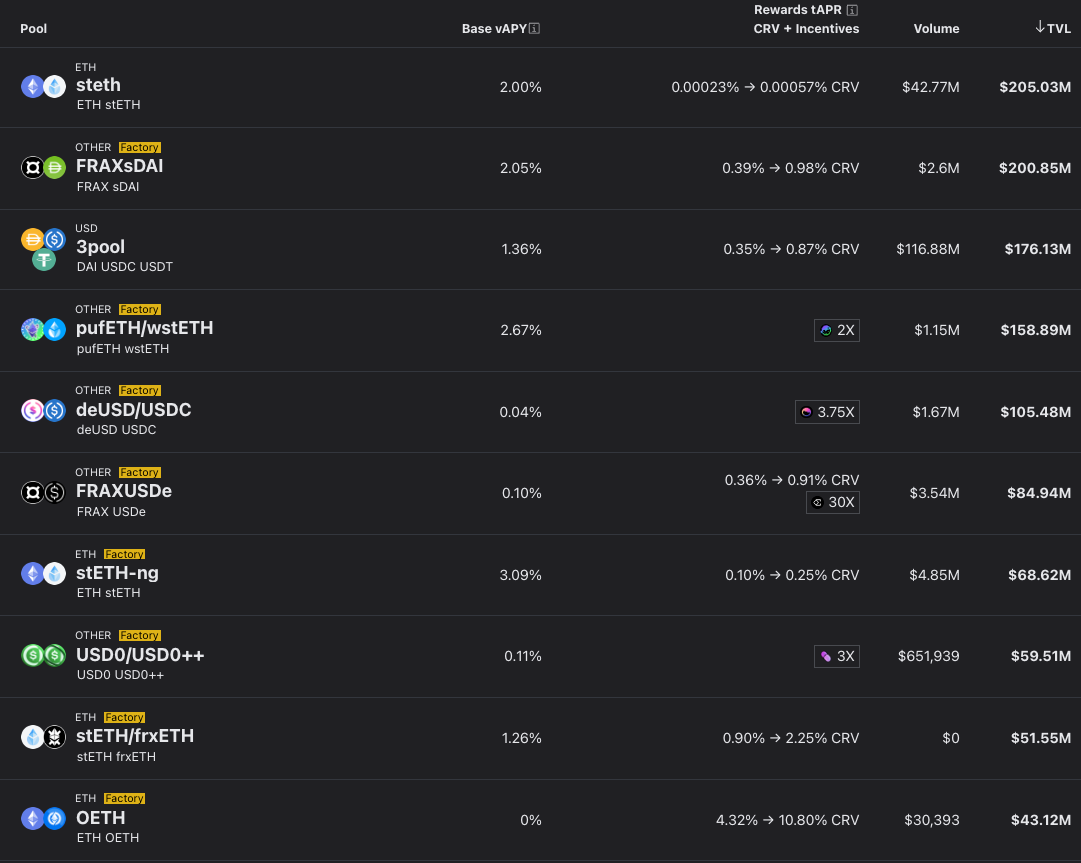

DEX

Despite the hefty attention on $crvUSD, Curve's DEX continues to thrive:

The DEX landscape continues to evolve with crypto trends. Nowadays, pools are less likely to be incentivized with $CRV emissions, and more frequently by native trading yields or points.

The points narrative has been strong enough to work its way into the Curve UI. Observe some notable recent pools promoting points:

In the 30 minutes since deUSD was announced, its USDC pair is already the most liquid single stable pair on Curve, with total deUSD liquidity north of $100mm pic.twitter.com/CuGeRADsMb

— Cole (@cole0x) July 31, 2024

Pills or real yield: what wins? @usualmoney pic.twitter.com/DumdSQfq7U

— Curve Finance (@CurveFinance) July 17, 2024

Boosted weETHk/weETH and weETHs/weETH pools on @CurveFinance, both pool have a 4x https://t.co/gbHcksxzp2 points boost for a limited time! pic.twitter.com/trWod1AjBE

— ether.fi (@ether_fi) July 28, 2024

ezpz ETH might be my favorite LRT farm at the moment, as it gives efficient exposure to EigenLayer + Symbiotic + Renzo + Mellow

— The Teriyaki Don (@TheTeriyakiDon) July 15, 2024

ezETH = Renzo's EigenLayer LRT

pzETH = Renzo's Symbiotic LRT

No wasted ETH like in most LRT DEX pairs pic.twitter.com/scvCgtBO0o

The #LRT points are erupting on Eigenpie’s Liquidity Rush #2 Campaign!🌋$mswETH / $rswETH liquidity providers of @CurveFinance’s pool on @ethereum are in for a treat:

— Eigenpie (@Eigenpiexyz_io) July 29, 2024

🚀 4x @Eigenpiexyz_io Points

🤝 2x Group Boost

🦪 Boosted @SwellNetworkio Pearls

Provide liquidity now and… pic.twitter.com/aTNcESxkTQ

1/ 🎉 Our first liquidity pool is here! 🎉

— YieldNest (@YieldNestFi) July 30, 2024

Discover our $ynETH LP on @CurveFinance with @LidoFinance’s wstETH.

👉 https://t.co/yzLSvGBTeY

Join & receive a HUGE 5x Seed boost, attractive $CRV APY, and much more.

This marks a new chapter for YieldNest. Why?

Read on. pic.twitter.com/I0UPn97DwG

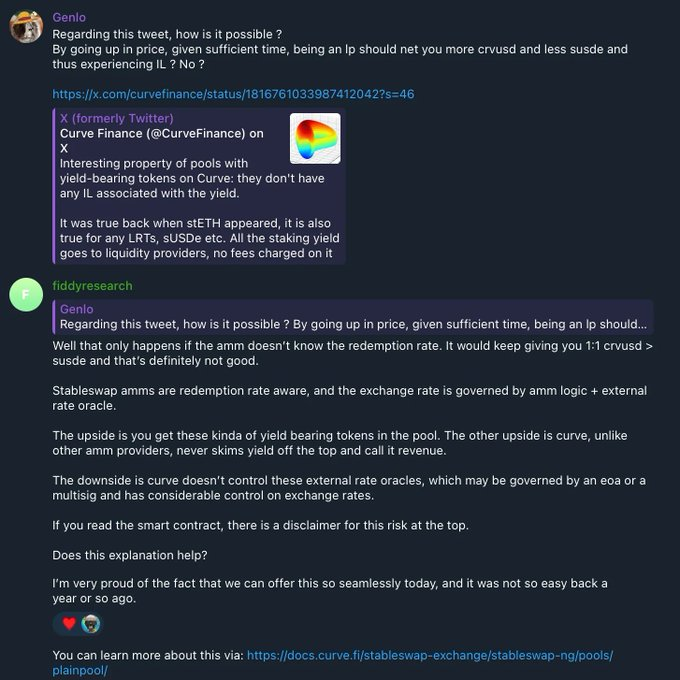

NG pools boast major advances in technology, which have underpinned several recent trends including pool efficiency leading to elevated native APYs. Here is a look under the hood at some of the power of NG pools for redemption rates:

Other News

A major story for the month of July is the flurry of locking.

Amount of CRV locked over last week is 3 times larger than CRV emissions (that's before the reduction mid-August) [credit to @0xcrv_hub] pic.twitter.com/CDRZJLQe55

— Curve Finance (@CurveFinance) August 1, 2024

The locking frenzy was covered in an article by OurNetwork that reviews updates of major lockers Convex and Stake DAO

Lock rates are not the only "up only" chart around Curve lately. Raw transactions are looking good...

Interesting! @CurveFinance pic.twitter.com/XW1KTSXSSa

— Philipp (@phil_00Llama) July 8, 2024

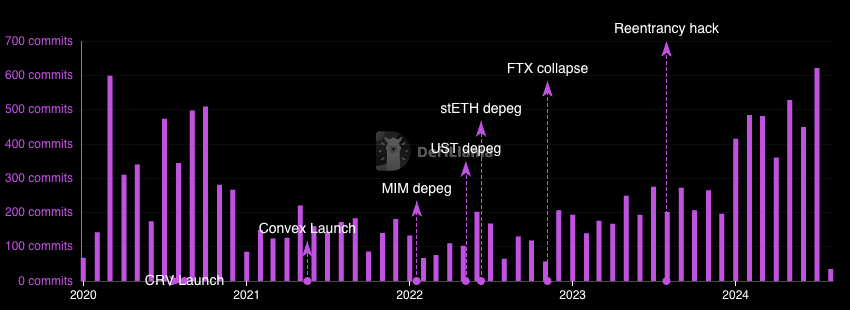

The most exciting hockey stick line is surely the Curve Github repository

https://t.co/d9X6J7bMdS

— Curve Rider 🦇🔊 (@curvellama) July 31, 2024

Purple Line are developer commits - curve devs are cooking 👏$CRV #DeFi $ETH

The Curve Github repo is always best place to catch all the latest updates on Curve. One fun recent update is a means to open fee collection to the public.

@CurveFinance latest update allows anyone to participate in veDAO fees(a.k.a. admin fees) collection 🥷🏼 Due to many updates and new projects 🧮 it is hard 🔀 for the team to follow all revenue sources 🌊 leading to some cushions 💼 accumulated.

— Roman Agureev (@agureevroman) July 8, 2024

Join collection and earn a tip! 💸

Another major dev update is Curve's deployment to Mantle, the 16th officially supported chain:

Not many noticed, but Curve silently deployed on @0xMantle pic.twitter.com/j05j9Fy3J5

— Curve Finance (@CurveFinance) July 19, 2024

Adjacent to Curve, the community led development of CRVHub has added a great new resource for Curve, which now adds onchain commenting on proposals.

Introducing our governance system🔥

— CRVHub (@0xcrv_hub) August 1, 2024

You can comment on each proposal !

Completely on-chain without gas fees; just a message signature, thanks to account abstraction

Rate limits:

• 10 messages/user/day

• 200 messages/day globally

Enjoy it 👉 https://t.co/ijtRxbFO7t https://t.co/DTOwuYE5xV

Talks

The Curve team mostly talks through code, but occasionally turns to words.

Martin Krung spoke at ETH CC

Great talk from @martinkrung at @EthCC:

— crv.mktcap.eth (@CurveCap) July 29, 2024

"How soft-liquidation works in Curve lending"https://t.co/yuUXjpGBEi

And Curve Founder Michael Egorov has been particularly busy, doing a fireside chat at Stable Summit.

Video with @DeFiDave22 interviewing me at Stable Summithttps://t.co/pUpLaybLT1

— Michael Egorov (@newmichwill) July 8, 2024

To celebrate $CRV being listed on HashKey, he also participated in a great space on 𝕏

🎙️HashKey Global #AMA: Exploring Stablecoin Innovations & @CurveFinance Roadmap

— HashKey Global (@HashKey_Global) July 29, 2024

Join us with

🌟 @newmichwill, Founder of @CurveFinance

🌟 @thisisRita_Liu, CEO of @RD_Technologies

🌟 @ben_el_baz, MD of @HashKey_Global

⏰ Time: 9:00 UTC, July 30

📍 Space: https://t.co/PQ31qaWakY pic.twitter.com/yqd7NCcAtD

Until his next time talking, you can get his hottest takes directly on Telegram

I will be writing some takes in English and Russian languages in these telegram channels:https://t.co/P2RsKepmfc and https://t.co/0lKoIshsdI

— Michael Egorov (@newmichwill) July 31, 2024

For a monthly digest, subscribe to the official Curve newsletter below. Your email will never be used for any other reason than email this newsletter to you!