Ahead of the Curve - November '24

A two-week campaign on the cbBTC/WBTC @CurveFinance gauge is live.

— Gauntlet (@gauntlet_xyz) October 31, 2024

In the few days since launching with $26K incentives, the gauge has received 5.6M veCRV votes.

The tAPR is increasing 9.16% → 22.90% CRV. pic.twitter.com/MLOnWswUfy

In a month full of treats, one of the sweetest came on Halloween, with news that Gauntlet is providing incentives on behalf of a cbBTC/WBTC pool. Otherwise, Curve was up to plenty of tricks throughout the month.

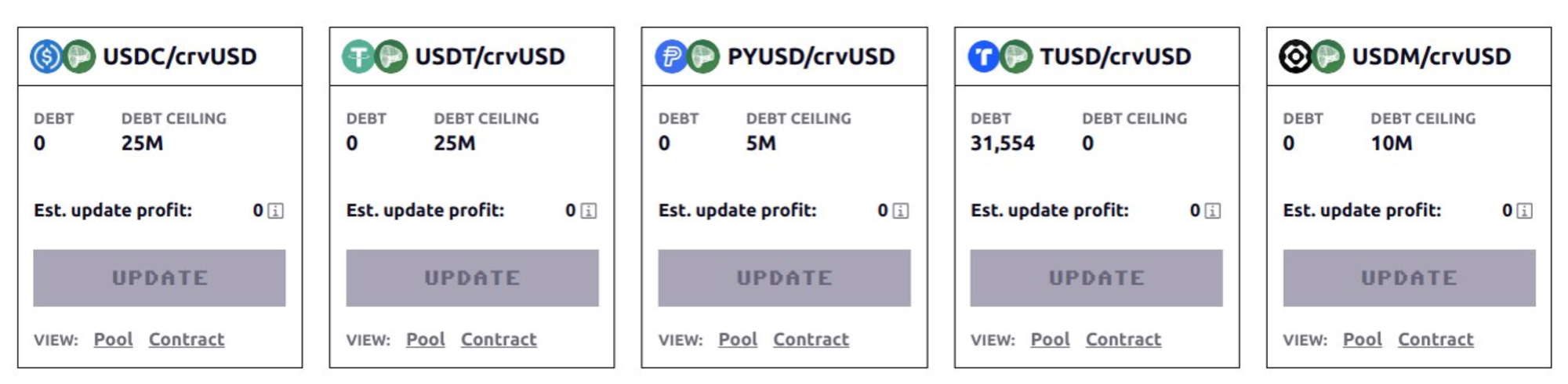

The $crvUSD receiving a new Peg Keeper, as $USDM replaced $TUSD. This is a yield-bearing stablecoin from Mountain Protocol, which earns from Treasury Bills. More details are available here: https://news.curve.fi/crvusd-adds-usdm-pegkeeper/

USDM has been onboarded to @CurveFinance's crvUSD PegKeeper module, enhancing crvUSD's peg stability with a safe and liquid stablecoin.

— Mountain Protocol (@MountainUSDM) October 23, 2024

LPs can supply to the crvUSD/USDM pool to earn swap fees, CRV gauge rewards, and native USDM yield. pic.twitter.com/yC50laaGre

Incidentally, if you are interested in seeing the Peg Keepers in action, the UI has been updated to track Peg Keeper status changes automatically, even allows observers to claim profit by calling the update function.

We have a new PegKeepers page btw!https://t.co/R26Rmg7heA https://t.co/LELF1dKzE3 pic.twitter.com/VeyPr6VUXi

— Curve Finance (@CurveFinance) October 23, 2024

Development

Dev activity on @CurveFinance is at an all-time high🧐

— Diego.crv (@Die_crv) October 4, 2024

The DeFi kingmaker is preparing its next big move...(forexshhhhhhh🤫)

Bullish on $CRV pic.twitter.com/al34vzSgDa

As always, Curve devs have been busy. October saw the results of several audits. The Curve Fee Splitter received a full audit from ChainSecurity. The Fee Splitter is a crucial part of the upcoming plan to launch scrvUSD (which earns a natural saving rate). ChainSecurity praised that “the codebase provides a high level of security.”

The codebase is notable for using the new Vyper 0.4 module system, which means that some Snekmate code was covered within the scope of the audit.

this is cool to see - snekmate modules being part of Curve audits 😎. 0 issues found (the low ones are unrelated to snekmate). Appreciate the trust of Curve into my Vyper code 🫡 https://t.co/nfGEl6p3lO pic.twitter.com/WD8r9raBJi

— sudo rm -rf --no-preserve-root / (@pcaversaccio) October 3, 2024

The actual scrvUSD contracts were not included in the audit, because they are a fork of the audited and battle tested Yearn v3 vaults.

For more details on the business case of scrvUSD, check the following post:

Progress towards Savings crvUSD is accelerating, marking a pivotal moment in the evolution of Llamalend's structure.

— fiddy (@fiddyresearch) October 23, 2024

---

0. When a stablecoin depegs upwards, pegkeepers mint new stablecoins to bring the value back down. This mechanism has proven highly effective.

But when the…

The other major audit released this past month was the MixBytes audit of Curve's lending platform, known popularly as Llama Lend. The audit was also favorable, and covered multiple snapshots in the development history. We recommend to read through the full audit yourself:

🔍 The audit of @CurveFinance's Lending protocol has been successfully completed! pic.twitter.com/MQC0RH8Ocg

— MixBytes (@MixBytes) October 2, 2024

Lending

Llama Lend contracts were deployed to Optimism and Fraxtal last month. This month the various gauges and integrations got connected to bring the markets to life.

1/ Curve's LlamaLend lands on Fraxtal!

— Frax Finance ¤⛓️¤ (@fraxfinance) October 24, 2024

As part of our longstanding positive-sum partnership with the DeFi legends at Curve, LlamaLend is now on Fraxtal, our Top 14 L2, where DeFi super users transact.

Get started here: https://t.co/dgm783wNsq pic.twitter.com/Ti0X3eYXKf

Curve lending on @fraxfinance Fraxtal just got pretty price graphs https://t.co/w0vMzgvAEG pic.twitter.com/Xs6wvXUp1Z

— Curve Finance (@CurveFinance) October 27, 2024

Llamalend LPs on Fraxtal can now be staked on Convex Finance! pic.twitter.com/OLklsrKuS0

— Convex Finance (@ConvexFinance) October 27, 2024

Curve has already become a powerhouse on the Fraxtal chain, hoovering up 2/3 of the chain's TVL.

@CurveFinance has quietly accumulated 2/3 of all TVL on @fraxfinance Fraxtal. 👀 pic.twitter.com/hxU1qUzJsC

— Kmets (@kmets_) October 29, 2024

The game now turns to how to best drive liquidity to the various Llama Lend pools across the four chains. Curve's Martin Krung has been experimenting in public with a script designed to optimize incentives to grow lending markets over the course of two months, using 5000 ARB received from a grant to bootstrap the tBTC/crvUSD lending pool.

boostraping @tBTC_project tBTC token on @llamalend

— Martin K. 🦇🔊 (@martinkrung) October 23, 2024

over 8 weeks, a meta thread

1.https://t.co/13RzcEKOns

Other protocols are using points programs to draw users.

Ready for more? Our next guide will show you how to use your shiny new dlcBTC as collateral on CurveLend! Stay tuned! 👀 @CurveFinance

— dlcBTC (@dlcBTC) October 17, 2024

(This one has 5x Points Boost 🤫)

Turn on the 🔔 now!

The new YieldNest vault is the first to try offering points to both borrowers and lenders as part of their "Seeds" rewards program.

1/ Have you checked the APY and APR on the ynETH/crvUSD pair on @CurveFinance's Lending page?

— YieldNest (@YieldNestFi) October 21, 2024

🏦 With more than 55% borrowing APY, and 45% lending APR now is the right time to make use of our Curve DeFi integration!

🌱 And add the 6X Seeds boost on top of that! pic.twitter.com/SydJGkZJYV

At the moment, Llama Lend vaults are occasionally seeing elevated APRs for lenders.

crvUSD APRs are going up on @CurveFinance Llamalend on Arbitrum. pic.twitter.com/6gwWDRyxYC

— chago0x (@chago0x) October 19, 2024

For more details on how to integrate fully with Llama Lend on the developer side, Curve provides Github and video tutorials:

Nice tutorial for devs and bot operators, as usually! https://t.co/4c0I6ByUYS

— Curve Finance (@CurveFinance) October 21, 2024

Pools

When it launches, scrvUSD will not be the only yield-bearing stablecoin in DeFi. Multiple such stablecoins have become popular, and many more are launching, which could serve as natural pairings for trading pools. A narrative to keep an eye on lately has been that pools containing yield-bearing stablecoins natively draw very good trading activity.

Does it look like trading volumes slowly shifting towards yield-bearing stablecoins? pic.twitter.com/hkpOAP9vAK

— Curve Finance (@CurveFinance) October 23, 2024

This is the benefit of pegging with sDAI/sUSDS and yield-bearing stables in general. You get access to 1.3b in immediately accessible USDC liquidity, but the opportunity cost to LPs is way better.

— Sam MacPherson (@hexonaut) October 25, 2024

Look at the difference in yield for similar volumes. pic.twitter.com/QzqnvE5IKZ

sDAI/sUSDe pool is consistently printing, earning both of the staking APRs, exchange fees and points. Maybe that's why it keeps getting more TVL! pic.twitter.com/pQbciVcFOZ

— Curve Finance (@CurveFinance) October 10, 2024

gm. the high base vAPY of @USD_3 pools on @CurveFinance continues to look juicy. pic.twitter.com/jBQpwCVwxR

— Thomas Mattimore (tmattimore.eth) 🇺🇸 (@mattimost) October 30, 2024

While the effect is pronounced among yield-bearing stablecoins, a variety of other Curve pools also continue to experience high native trading APYs in the era of more NG pools being launhced.

Demand for swapping cbBTC from @coinbase goes up. 150% pool utilization and 7.6% unincentivized APR currently pic.twitter.com/r9K50Sd7tB

— Curve Finance (@CurveFinance) October 5, 2024

This cbETH pool on @base is doing quite wellhttps://t.co/ZC75J9AWiN pic.twitter.com/zANCGJWsHA

— Curve Finance (@CurveFinance) October 24, 2024

The phenomenon of elevated trading yields can occur for many reasons. For instance, the pufETH/WETH pool may be benefiting due to high gas fees.

Dynamic fee keeps printing! pufETH/WETH @puffer_finance pool surprisingly earns more than its bigger pufETH/wstETH counterpart.

— Curve Finance (@CurveFinance) October 17, 2024

Likely the reason is high Ethereum gas fees recently, so exchanges which do not involve wrapping/unwrapping are happening more often pic.twitter.com/YPZQi6WDsK

Other pools do well even when they are not yield-bearing.

tBTC pool with @TheTNetwork Bitcoin quitely makes 100% utilization. BTCFi? pic.twitter.com/mjKcMl5W6O

— Curve Finance (@CurveFinance) October 27, 2024

Some further interesting pool activity we noted from the prior month, if we missed any make sure to drop them in the comments and we'll update:

Another curious BTCFi opportunity is stBTC/tBTC. Keep in mind that "T" on the screenshot stands for @TheTNetwork token, not trillions 😄https://t.co/lin3ku3Lrl pic.twitter.com/kBliahhbzh

— Curve Finance (@CurveFinance) October 17, 2024

🆕 $asdCRV @CurveFinance pool on @arbitrum:

— Stake DAO (@StakeDAOHQ) October 9, 2024

• CRV Rewards surge 50% tonight

• New incentives round kicks off

• @0xconcentrator autocompounds $veCRV yield

Maximize your $CRV returns on Arbitrum pic.twitter.com/esNj1xDkzq

Hey Hinkalis, it's time for the DOUBLE rewards 🥩

— Hinkal (@hinkal_protocol) October 11, 2024

The rules have never been more simple:

• You will get 2x Hinkal Points for liquidity provision to the hETH/WETH @CurveFinance.

• You will also get 2x points for transactions with hETH inside Hinkal.

For example, you can swap… pic.twitter.com/suYy2lqH9D

Place your bets on better yields

— eBTC | Get Paid to Borrow Bitcoin (@eBTCprotocol) October 14, 2024

Aka the eBTC/tBTC pool on @CurveFinance 😉⤵️https://t.co/imUMIpG0Av pic.twitter.com/l32pfSO2hR

\

Not much but honest work! Some incentives arrived for @coinbase cbBTC pool https://t.co/DEzzvd8kyd pic.twitter.com/YE4a0JmvY0

— Curve Finance (@CurveFinance) October 17, 2024

$RCH lending market is now LIVE on Curve Lend (@CurveFinance)!

— SOFA.org (@SOFAorgDAO) October 24, 2024

Users can now use $RCH as collateral to borrow crvUSD!

Get started here ➡️ https://t.co/VWtSiT6rv2 pic.twitter.com/F1FGDCbTnH

We have just added 4 new @CurveFinance pools on @Base 🔵

— defi.money (@defidotmoney) October 17, 2024

Earn points and pool fees, in three easy steps 🥧

1) Mint $MONEY

2) Deposit into 1 of the 4 available Curve Pools

3) Stake your LP Token on Earn page: https://t.co/JdQnFUpVmJ

Enjoy 🌅 pic.twitter.com/UKAuLM9OdH

For the last case, defi.money is running an airdrop for veCRV holders via their points campaign.

BREAKING NEWS: New Airdrop for $veCRV holders!👀@defidotmoney is running a points campaign and guess what... veCRV holders are already earning points just because they own the most powerful protocol of the entire DeFi.@CurveFinance owns the stablecoin market! pic.twitter.com/MtZ5IBmPjC

— Diego.crv (@Die_crv) October 11, 2024

What's the best strategy for bootstrapping deep liquidity? It remains an open debate, but the community has some thoughts:

It’s hard to find someone and ask them what the exact strat is but the key takeaways is:

— fiddy (@fiddyresearch) October 15, 2024

1. You want deeply liquid secondary redemption markets: uni, bal and curve. @CurveFinance was crucial here because nobody would ever list rebasing tokens and @newmichwill took it upon… https://t.co/2jcKbetels

Many strategies for bootstrapping liquidity exist. At the end of the day, liquidity is not useful if it does not lead to facilitating trading. Fortunately, Curve is seeing increasing integrations with aggregators, leading to great trading volumes.

1️⃣/6️⃣

— Synthetix ⚔️ (@synthetix_io) October 23, 2024

USDx is live on @1inch with routing through @CurveFinance for fast, low-cost swapping with deep liquidity to and from nearly any asset on @arbitrum ⚡️🔄

🧵 pic.twitter.com/5S4pHRew1p

@_khanhamzah remember you asking once boss, the above mean

— Muggles⚙️🧰 (@mugglesect) October 23, 2024

- 5% of Balancer's ETH mainnet volume in 2024 came through Gearbox

- and 1.5% of Curve's mainnet volume

Cross-Chain

The EYWA CrossCurve ecosystem is ramping up, which promises to facilitate native cross-chain trading for Curve assets across several chains. Worth keeping tabs on their progress.

This is awesome to watch. Curve pools powering cross-chain swaps at the very core.

— Curve Finance (@CurveFinance) October 18, 2024

How will the CrossCurve system by @eywaprotocol perform when these monster pools grow in size? Looks like the guys decided to seriously find out! https://t.co/CwJ0ANbgLy pic.twitter.com/qrjSNDeAyA

Curve hosted a hackathon over the past month to find a team to bring Curve to the TON ecosystem. The results were livestreamed:

Live interview with @newmichwill and @ton_society now!https://t.co/RHhm7W1eva

— Curve Finance (@CurveFinance) October 7, 2024

Join us live to discover the winners that will get investments and support from Curve Finance in building the best stableswap on $TON! 💎

— TON 💎 (@ton_blockchain) October 24, 2024

Today at 7 PM UTC on TON Blockchain X & Youtube

Speakers - @CurveFinance, @eywaprotocol, @alenka_w3 , @VladDegen & @lmeowhelena

VC… pic.twitter.com/sTfxvNI09u

Safety

DeFi remains a minefield for hacks and scams. Over the past month, Curve spent a lot of time fighting to get a fake app taken down.

Btw this fake app was taken down.

— Curve Finance (@CurveFinance) October 28, 2024

Would love to thank @ChainPatrol for helping to expedite the request! https://t.co/h3AeCz4QNz

— ChainPatrol.io (@ChainPatrol) October 28, 2024

We can now point to some tangible evidence that Curve's insistence on using Vyper may correlate with safety.

And since the hack data now has language info, we can also do language-based stats! Rust may be safe, but clearly not web3 safe. Solidity fares better but @vyperlang slithers ahead 🐍. Java comes from a single data point on ICON. pic.twitter.com/SmwzWt4U5H

— benny lada (@bennylada) October 30, 2024

The Curve grants committee recently provided 250K $CRV tokens to Vyper to help fund its development. Read more on the language's progress here:

All about Vyper's latest security initiatives: comprehensive audits, contract monitoring and formal verification https://t.co/yMzNVMAFvZ

— benny lada (@bennylada) October 28, 2024

Special thanks to @CurveFinance @LidoFinance @yearnfi @CodeHawks @OptimismGrants and @unoreinsure for their help making Vyper safer than ever! pic.twitter.com/819fRg1UVb

For a monthly digest, subscribe to the official Curve newsletter below. Your email will never be used for any other reason than email this newsletter to you!