Ahead of the Curve - October '24

Another month of Curve in the books, featuring some impressive development updates.

— The LLamas (@WenLlama) September 23, 2024

Nothing to see here https://t.co/G1APPjpbF5

— Panda (@chonkypandu) September 22, 2024

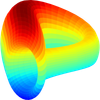

The Curve Fee Splitter, necessary for st-crvUSD, is headed for a DAO vote, meaning it could be live as early as October.

A vote to get fee splitter connected to the fee distribution process. It's a necessary dependency for staked crvUSD and (later) other interesting products an improvements!https://t.co/Xrh87Tk6Dt

— Curve Finance (@CurveFinance) September 30, 2024

The launch of $st-crvUSD will bring a native savings rate to Curve by redirecting some $crvUSD yield to stakers. This is intended as a liquidity sink to help $crvUSD stabilize rates and scale efficiently.

The dev team has been cracking, as this month also featured the publication of Curve Core, which would bring permissionless Curve deployment to any EVM chain, .

Lending

As BTC-Fi becomes a major narrative and other platforms grow trepidatious about governance changes to WBTC, Curve has flexed the safety of Llama Lend's isolated markets to allow the protocol to roll out the red carpet to several Bitcoin wrappers.

If you are a user with WBTC collateral, please be aware that you are WELCOME at https://t.co/EjL8SImCsN and https://t.co/j2zYaC6v18 https://t.co/DYjmElHxyu

— Curve Finance (@CurveFinance) September 12, 2024

cbBTC is up on Curve along with 90 BTC liquidityhttps://t.co/DEzzvd8SnL https://t.co/METm5keJYo pic.twitter.com/Rm4AnR1CoB

— Curve Finance (@CurveFinance) September 12, 2024

Apparently @TheTNetwork allows to deposit BTC natively on @arbitrum using this little-known link https://t.co/OTSZ2XtqSn.

— Curve Finance (@CurveFinance) September 12, 2024

Unsurprisingly, tBTC pool quickly become the top first pool on Arbi by trading volume. pic.twitter.com/ukpkdv7ncB

Llama Lend is for more than just Bitcoin of course. The SOFA.org non-profit DAO boasted of a launch onto the lending protocol.

$RCH is now live on Curve Lend! 🌟

— SOFA.org (@SOFAorgDAO) September 13, 2024

We’re expanding $RCH utility by integrating with @CurveFinance Lending Protocol, allowing $RCH to be used as collateral to borrow crvUSD.

This step aligns with our mission to enhance DeFi infrastructure and create long-term value for our… pic.twitter.com/dgLgSRKdOe

In total 49 separate markets have already been created, and Llama Lend now sits on four chains following this month's deployment to Optimism and Fraxtal.

Llama Lend on the Superchain?https://t.co/gx5uea2yF8

— Curve Llama Lend (@llamalend) September 23, 2024

The soft liquidation mechanism continues to rack up successful use cases of protecting user assets.

Is soft liquidation (or should we say liquidation protection) efficient?

— Curve Finance (@CurveFinance) September 6, 2024

This position in asdCRV market on Arbitrum was created 36 hours ago and immediately went under liquidation price. Over these 36 hours "in liquidation" during this "Megalodon Whale Dump" it lost only 0.1%. pic.twitter.com/LHMtSRyVER

With so many markets on so many chains, there's increasing opportunity to learn how to perform liquidations.

Want to help @llamalend from @CurveFinance eliminate bad debt and make a few profits? 🫡

— xtycoon (@xtycoonfi) September 4, 2024

I've just shared an example of a liquidation bot that you can use as inspiration. 🤖

Available here: https://t.co/bl5lnHXp6D

The Titanoboa Llama Lend liquidation tutorial contains many examples of how to perform a variety of liquidations.

The past month even saw the first usage of the crvUSD Flashlender, which can also be utilized for liquidations.

Someone finally did a crvUSD flashloan (feeless, capped at 1M)https://t.co/3mIpgn4KPn

— fiddy (@fiddyresearch) September 8, 2024

wew!

As a reminder, in addition to the official Curve UI, the team at DeFi Saver also provide a great interface to $crvUSD and Llama Lend.

💡ICYMI: We have both CurveUSD and LlamaLend supported (across mainnet and Arbitrum).

— DeFi Saver (@DeFiSaver) September 5, 2024

This includes dedicated dashboards with our signature features, such as 1-tx leverage management, Loan Shifter support, and even some Automation options (though those are currently specific to… https://t.co/xdw1LwhmRe

Continued adoption of $crvUSD throughout DeFi serves to boost the available sinks for the stablecoin. Inverse Finance this past month has been collaborating with Curve on crvUSD-DOLA LP tokens on FiRM

👉Big news: the debut of our latest LP collateral token on FiRM - crvUSD-DOLA on @yearnfi - is here! pic.twitter.com/TkCxujBayS

— Inverse (@InverseFinance) September 24, 2024

Ka-boom!🔥 … in one of our most significant collateral additions yet, we’re proud to announce the debut of crvUSD-DOLA LP tokens on FiRM in close collaboration with @CurveFinance and @ConvexFinance ! 🤝 pic.twitter.com/2F1YX3e8Ok

— Inverse (@InverseFinance) September 16, 2024

Meanwhile the $crvUSD - $MONEY pool has been enticing users on Arbitrum via points program. $MONEY is a stablecoin from defi.money, a team that operates an authorized fork of the crvUSD LLAMMA and directs a portion of revenues to the DAO.

And $crvUSD / $MONEY pool seems to be giving most points! https://t.co/SRUxOJ9F77

— Curve Finance (@CurveFinance) September 11, 2024

1/ @yearnfi 𝕧𝕖ℂℝ𝕍 𝔹𝕆𝕆𝕊𝕋 𝕊𝔼ℚ𝕌𝔼ℕℂ𝔼 𝕀ℕ𝕀𝕋𝕀𝔸𝕋𝔼𝔻...

— defi.money (@defidotmoney) September 18, 2024

> Earning more points activated…

> Powering Up defi money Systems...

> Connecting to Curve pools... OK

> Verifying Liquidity Pools… Stable

𝕊𝕐𝕊𝕋𝔼𝕄 𝕊𝕋𝔸𝕋𝕌𝕊: 𝕆ℙ𝔼ℝ𝔸𝕋𝕀𝕆ℕ𝔸𝕃… pic.twitter.com/cbR3tN6E6o

Pools

The phenomenon of high APY pools, delivered by stableswap-v2's dynamic fee structure, continues to turn heads. Such as this $weETH / $WETH pool:

The $weETH / $WETH pool on @CurveFinance is printing money! 🔥💵💸 pic.twitter.com/9MEKSVgN7O

— CRVHub (@0xcrv_hub) September 20, 2024

Something about capital efficiency. Somehow this weETH/ETH pool on Curve is doing the same volume as Uniswap's pool for weETH, despite 5 times smaller TVL.

— Curve Finance (@CurveFinance) September 12, 2024

And no, the fee doesn't explain that pic.twitter.com/Tcpa3CK3kk

And USD3 pools earning 20%:

genuinely wondering why USD3 pools on @CurveFinance do not get more deposits.

— Thomas Mattimore (tmattimore.eth) (@mattimost) September 27, 2024

Base yield of 20% with no incentives is wild! pic.twitter.com/cZn9WgmghT

Perhaps this effect is in protocols minds as they launched several new pools this month.

DYAD belongs on Curve.

— sovereign Llama (@sovereignllama) September 5, 2024

DYAD Frax NG factory pool interesting https://t.co/y3YsoPSQkF

hETH reached $3M volume in our @CurveFinance Pool!

— Hinkal (@hinkal_protocol) September 25, 2024

Anonymity Staking is shaping the privacy ecosystem - and our stakers are the main drivers of it!

Deposit your hETH in the Curve Pool to enjoy extra yield: https://t.co/Fy8e35DrD4 pic.twitter.com/xSEi3ZrKAE

New Liquidity Pools Now Live on @CurveFinance!

— Solv Protocol (@SolvProtocol) September 24, 2024

We’ve deployed two new pools to strengthen liquidity for SolvBTC and SolvBTC.BBN:

🔹 SolvBTC/WBTC – $4.0M TVL

🔹 SolvBTC.BBN/SolvBTC – $1.9M TVL

These pools provide key support for BTCFi and further expand liquidity for Bitcoin… pic.twitter.com/nJP6CQgJyq

🚨 dlcBTC/wBTC @CurveFinance pool has crossed $3,000,000 in TVL. Helping to put about 50 BTC to work on Curve without loosing L1 Custody.

— dlcBTC (@dlcBTC) September 24, 2024

What's your Bitcoin doing sitting idle? 🤔

dlcBTC/wBTC pool current APY 7.16% https://t.co/ZalOTpmutu pic.twitter.com/dL4PBwYXvC

On Arbitrum the $asdCRV wrapper has been playing with a unique design.

Gain direct exposure to @CurveFinance $veCRV yield, native fees & vote incentives, on Arbitrum via $asdCRV pool.

— Stake DAO (@StakeDAOHQ) September 8, 2024

Unique design directs $vsdCRV voting power to the pool, scaling $CRV rewards with pool TVL. pic.twitter.com/MfgsjpL1Mq

The $asdCRV pool on Arbitrum received new $veCRV votes last week and the $CRV started streaming yesterday.

— Stake DAO (@StakeDAOHQ) September 13, 2024

Earn the " $CRV staking yield" on Arbitrum! pic.twitter.com/1dgLlrMd3E

Despite dwindling users in a bear market, some great pockets of rewards have popped up. DeFi summer vibes?

For instance, several Arbitrum pools enjoyed some elevated rewards this month.

oh wow double rewards for a bit on @CurveFinance on @arbitrum for eUSD and ETH+ pools pic.twitter.com/wQxUVAmxKU

— Thomas Mattimore (tmattimore.eth) (@mattimost) September 12, 2024

Vote efficiency is as high as $1.80 return on the dollar

Weeks after weeks, @ZunamiProtocol is depositing vote incentives on Votemarket to obtain $veCRV votes for $ZUN-related pools.

— Stake DAO (@StakeDAOHQ) September 25, 2024

Last round, for every $1 deposited, @ZunamiProtocol managed to direct $1.80 worth of $CRV towards these pools thanks to Votemarket voters. pic.twitter.com/WtSNB5l7IY

With governance markets and so much activity, it amounts to a nice steady payday for veCRV holders.

Maybe you don't know but plus the "classic" fees that @CurveFinance earns (Dex fees and $crvUSD interest rate) (average now is ~$350K/week), there is also another revenue stream

— Diego.crv (@Die_crv) September 10, 2024

I'm talking about the Bribes market (average now is ~$150K/week)

Curve is currently earning ~$500K/w pic.twitter.com/cA1ThWFnLA

More

Curve has been hosting a hackathon to bring the Stableswap to TON Blockchain.

Rumor has it it's generating a TON of interest.

Meanwhile, if you are interested in Curve merch, you may have some stylish choices hitting the market soon.

Finally, want to hear from your favorite Curve team members?

I heard Michael will singing soon,check the Curve TG group:https://t.co/BPyx8TGf6a https://t.co/sIsDsYySC4

— haowi.eth🦙🦙🦙🚀🚀🚀 (@HaowiWang) September 20, 2024

Well, no singing clips have surfaced yet. But Michael Egorov spoke at three events around Singapore.

“It’s become evident that we need to pay more attention to Bitcoin as a DeFi asset, because that’s where the demand is.”

At the BTC ECO summit he demonstrated results showing off the superiority of Bitcoin as an asset for borrowing in LLAMMA.

At the Stablecoin Summit he delivered a fireside chat he talked plans for st-crvUSD, and expressed ambitions for Forex and eliminating impermanent loss without emissions.

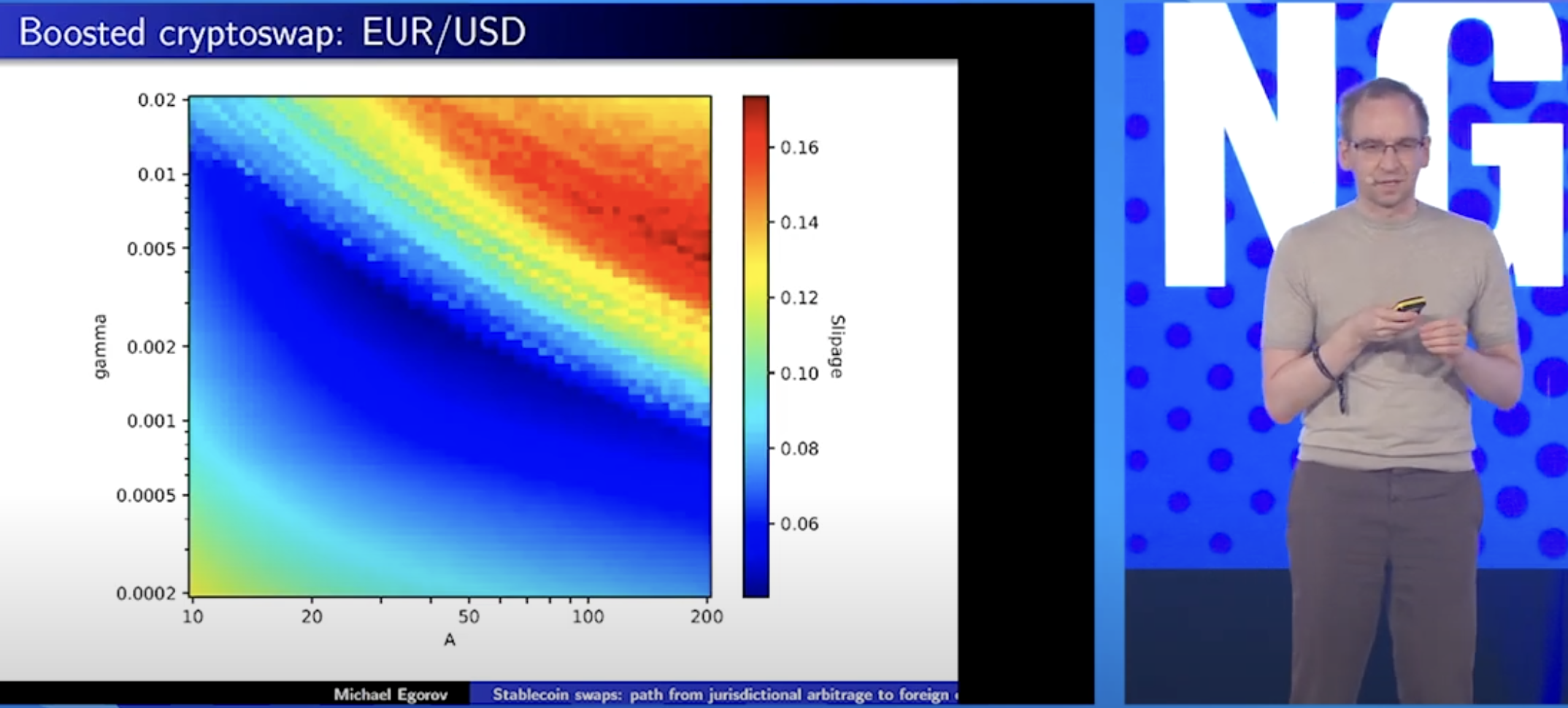

At the main event, he delivered a talk entitled "Stablecoin Swaps: From jurisdictional arbitrage to FX Markets," showing off some considerations in price impact for Forex trading

Finally, Curve developer Alberto Centonze joined Leviathan News for a chat about developing st-crvUSD, and more.

For a monthly digest, subscribe to the official Curve newsletter below. Your email will never be used for any other reason than email this newsletter to you!