Ahead of the Curve - September '24

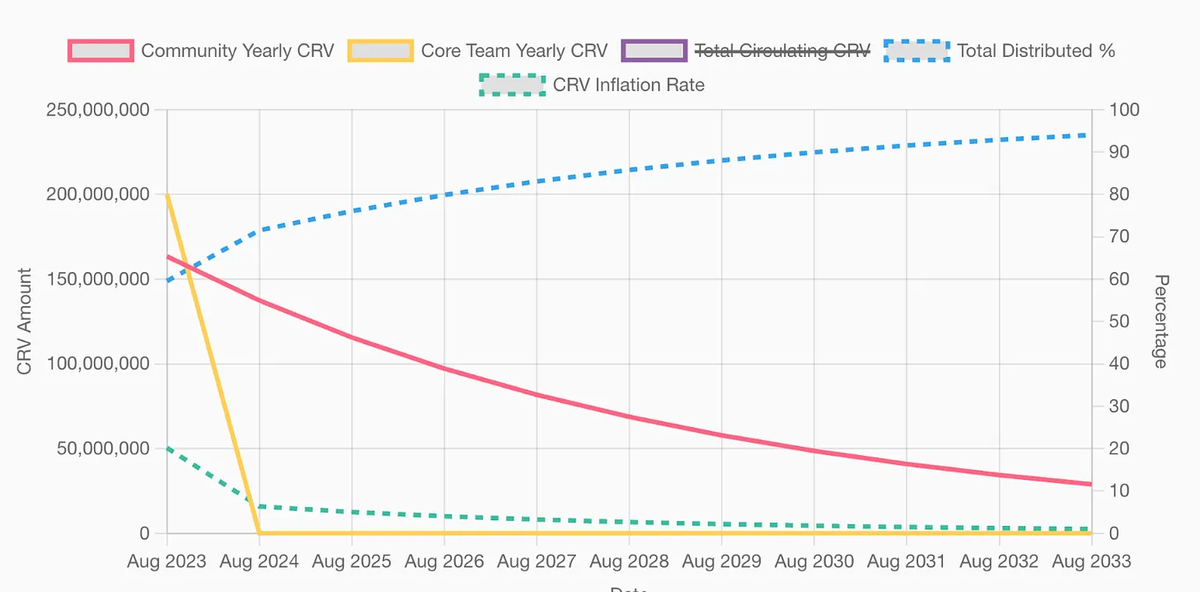

In the 300 year arc of Curve, August 2024 will most likely be known for the major Curve emissions reduction:

Between the inflation cuts and revenue increases, Curve is turning "profitable" (depending on how you map traditional financial accounting methods into the web3 world).

Actually this data does not include veCRV voting incentives which are huge. So Curve DAO is _already_ a profitable project https://t.co/8J304uZqeZ

— Curve Finance (@CurveFinance) August 27, 2024

At times this even led to periods where incentives could provide a nearly 2x efficiency bonus!

Protocols with liquidity on @CurveFinance are beginning to wake up from defi hibernation and a DeFi renaissance is beginning to form a strong narrative, especially as it relates to cash flowing playershttps://t.co/uoFjJIRrEb

— Boz 🛡️ (@boz_menzalji) August 24, 2024

For every $1 in incentives, there are $1.98 in… https://t.co/5rOEAPTzEL pic.twitter.com/nl3BsT78wM

Lending

As happens so often in cryptocurrency, markets in August were volatile. However, borrowers in crvUSD and Llama Lend were comfy. While markets dumped, soft liquidation automatically converted their positions into crvUSD. Whenever prices reversed, these positions were automatically de-liquidated on the way up.

True, if the men of the mini plunge protection team took advantage of the soft liquidation mechanism via @CurveFinance lending platform, they could remain in an underwater position for weeks and come out back on top if/when price recovered 💯

— CrediBULL Crypto (@CredibleCrypto) August 13, 2024

It's a unique and first of it's kind… https://t.co/qstHkh5xVY

On https://t.co/EjL8SImCsN, some positions went fully soft-liquidated, but they are still open! They will be automatically converted to ETH on the way up (if they keep watching their health) pic.twitter.com/AyQP5iQi9z

— Curve Finance (@CurveFinance) August 6, 2024

With many users unfamiliar with the novel mechanics of LLAMMA, the volatile markets provided such borrowers with a crash course in best practices, like keeping an eye on health instead of liquidation prices.

When you are under liquidation price - you still can stay alive on https://t.co/j2zYaC72QG or https://t.co/EjL8SInail, no matter what the price of your collateral is! But remember:

— Curve Finance (@CurveFinance) August 22, 2024

- Need to keep watching your health and repay if it goes lower (<1% is real low, 3% is pretty… pic.twitter.com/1Qfoqbn6s8

August 6, 2024: Soft Liquidation For Dummies 📚🤪

— crv.mktcap.eth (@CurveCap) August 6, 2024

The single biggest misconception about LLAMMA soft liquidations

In yesterday's market crash, $crvUSD users most often got this one concept wrong...

🪡THREAD CONTENTS

2-3: MYTHBUSTING

4-7: FAQ

8-12: CASE STUDY

🧵1/13👇 pic.twitter.com/i5ffNNcAaV

Traders don't necessarily need to understand the underlying mechanics of the Peg Keeper, but under the hood these special contracts have unique powers to mint $crvUSD and trade these into their affiliated pools to keep the stablecoin on peg.

This month we saw more data on Peg Keepers added to the UI, including the ability for users to help claim profits (and get a portion for the help!)

Need some spare cash for borrowing or lending on Llama Lend?

— Curve Llama Lend (@llamalend) August 22, 2024

New UI to get paid for calling the Peg Keepers' update and get a piece of their profits.

The tricky part is getting more than you use in gas before others swipe the opportunity...https://t.co/RZfWQhjA0I pic.twitter.com/YHGlkLUTlg

crvUSD price seems fairly stable on peg recently. That's no coincidence: it is rock stable when pegkeepers are not empty (which is, when market borrow rates are not too high!) pic.twitter.com/TvA0A76mwQ

— Curve Finance (@CurveFinance) August 21, 2024

If you are studying Curve lending markets, traders will surely want to study advanced tactics like leverage trading.

🦙🌈Curve LLAMALEND (@llamalend) offers some intriguing opportunities to maximize your yields in DeFi. Here are two strategies that stand out:

— Jordi in Cryptoland (@lordjorx) August 27, 2024

1️⃣ crvUSD against WETH: With leverage up to x10 and an APR ranging from 6.30% to 13.82%, this strategy is perfect for those looking to… pic.twitter.com/5DcNn5jqOv

For very advanced users, look into performing your own liquidations using Flash loans.

crvusd feeless flashloan liquidity source on ethereum: https://t.co/DWgKyi8KZt

— fiddy (@fiddyresearch) August 1, 2024

please enjoy and keep our liquidity pools healthy!

Want to help @llamalend from @CurveFinance eliminate bad debt and make a few profits? 🫡

— xtycoon (@xtycoonfi) September 4, 2024

I've just shared an example of a liquidation bot that you can use as inspiration. 🤖

Available here: https://t.co/bl5lnHXp6D

The Llama Lend Titanoboa tutorial series has everything you need to get up and running to interact with Llama Lend markets using Python/Vyper.

🐍 Curve @LlamaLend Titanoboa Tutorial 🐍

— crv.mktcap.eth (@CurveCap) August 14, 2024

Lesson 5: Soft Liquidation

This unit shows off how to perform soft liquidations by executing basic trades into and out of the AMM.

We also show off some basic Matplotlib plotting and boa's anchor command.

🧵1/4👇 pic.twitter.com/Ri46AXboOa

Pools

A developing narrative lately has been the rise of high base APY pools.

USD3 pools on @CurveFinance have quite high base APY

— Thomas Mattimore (tmattimore.eth) (@mattimost) August 28, 2024

The rise of the high base APY pools continues... pic.twitter.com/SpnSMnOPn1

StableSwap-NG pools have a dynamic fee structure, in which a larger fee is charged when the pool is imbalanced. This serve as a tax on arbitrageurs, whose rebalancing trades will be profitable regardless of fees.

The end result has been several pools enjoying notably high APYs, often times in excess of rewards.

LRT pools are doing very well. This one (https://t.co/ko1MwGIZ65) has 870% utilization pic.twitter.com/vTBKoBMqa6

— Curve Finance (@CurveFinance) August 6, 2024

Apparently AUSD stablecoin, while having a tiny pool, does 1500% utilization, so the pool makes fees for LPs without any incentives. If anyone wonders - it is seemingly this onehttps://t.co/PL3w7Y78PM pic.twitter.com/tXRrRS2W8O

— Curve Finance (@CurveFinance) August 30, 2024

While @defidotmoney might not yet be launched, their pool has the highest fee APY on Optimism, followed by a sUSD pool.

— Curve Finance (@CurveFinance) August 5, 2024

Testing in prod before launch is a good thing! pic.twitter.com/W99M9fvBDC

TriCrypto pools also performed well in periods of volatility.

Tricrypto pools are printing well in such volatility. TricryptoUSDT has params which lead to higher fee APR on average, TricryptoUSDC - to higher volume pic.twitter.com/wJCvKDW0Je

— Curve Finance (@CurveFinance) August 5, 2024

All Curve pools also enjoy 24/7 uptime even in the most extreme conditions, as they do not rely on concentrated liquidity.

Missed this yesterday. It appears, that Uni3-style concentrated liquidity could not keep up with markets (moving it makes "impermanent loss" permanent), while Curve liquidity in crypto pools is automatically managed.

— Curve Finance (@CurveFinance) August 6, 2024

So while Curve is an AMM, Uni3 is closer to orderbooks pic.twitter.com/5LZ5HaOie4

With the $crvUSD peg tighter than ever, it's been a good opportunity for yield farmers looking for dollarcoin yield.

Glad to see a lot of pretty safe options for safe yield with crvUSD pools. Quite a good time to explore as crvUSD peg is ideal $1 these days pic.twitter.com/JQAdF7oo4E

— Curve Finance (@CurveFinance) August 22, 2024

Bitcoin pools have also made a comeback lately, as the token's relative strength has seen pools for newer tokens like stBTC, dlcBTC, eBTC and many more in the pipeline.

This happens in the wake of the emerging "BTC-Fi" narrative, as well as concerns about governance changes to WBTC.

Proposal from @TheTNetwork to save WBTC 🤔

— Curve Finance (@CurveFinance) August 29, 2024

Interesting times https://t.co/TVq52dbdS7

Note for yield farmers looking to maximize their boost to look at the growth of Onlyboost, which automatically optimizes between Convex and Stake DAO.

🚀 Milestone: $20M+ TVL in @CurveFinance Onlyboost gauges on Stake DAO!

— Stake DAO (@StakeDAOHQ) August 22, 2024

👉 Optimize $CRV yields automatically between Stake DAO & Convex.

One platform, maximum $CRV rewards. Stake on Onlyboost now! 📈 pic.twitter.com/hFWCw4mHmd

Governance

Curve governance continues to be actively reshaped in realtime, with Reserve Protocol taking advantage of market conditions to increase their voting power.

Making big moves....

— Reserve (@reserveprotocol) August 28, 2024

✅ Millions in @CurveFinance sdCRV and @StakeDAOHQ SDT locked up

✅ RToken liquidity supercharged

Full details and overarching strategy ↓https://t.co/7l3Zol2g9d

This purchase gives the Reserve ecosystem the most voting power of any non-founder entity in the Curve DAO https://t.co/hyi2wznpM2

— nagaking (@nagakingg) August 28, 2024

It was a big month in governance, with a successful DAO vote to provide a grant to Swiss Stake, the company building Curve. In the process the company provided a snapshot of all the progress from the company looking backwards:

Here is a review of what Swiss Stake (company building Curve) did so far! pic.twitter.com/R0PjjTX9mQ

— Curve Finance (@CurveFinance) August 19, 2024

Plus a roadmap looking forwards:

Scope of the works is mentioned here https://t.co/NavLzVCp7E pic.twitter.com/UjAAwJoNMS

— Curve Finance (@CurveFinance) August 22, 2024

But by far, the most contentious vote took place outside of the DAO, as Curve fans debated the style of the UI

Should Curve go back to its roots with a retro branding? It would be the old skool retro style windows sqrt(2) frontend design but modern ux backend.

— fiddy (@fiddyresearch) August 25, 2024

For a monthly digest, subscribe to the official Curve newsletter below. Your email will never be used for any other reason than email this newsletter to you!