Curve Best Yields & Key Metrics | Week 1, 2025

Weekly yield and Curve ecosystem metric updates as of the 3rd January, 2025

Market Overview

Curve's TVL rose to $2.501B this week, with strong fee generation led by Usual's USD0 pools which utilize dynamic fees, a feature of Curve's new Stableswap pools.

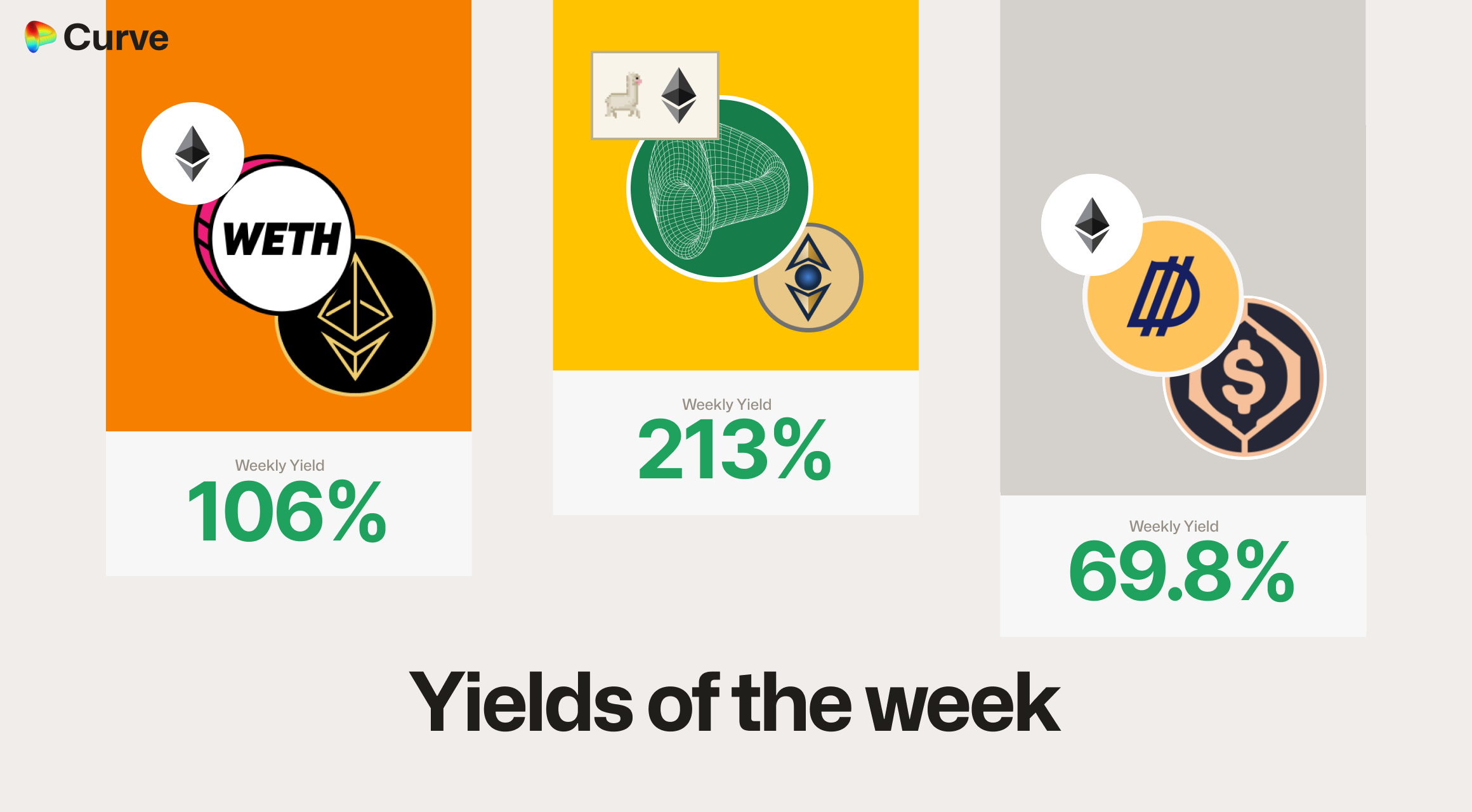

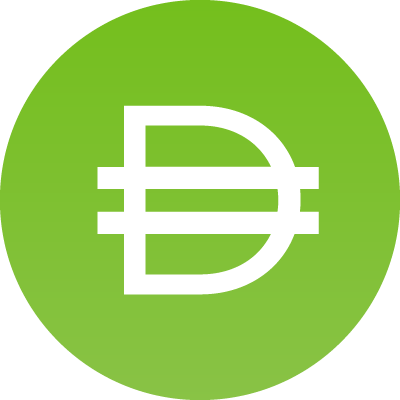

LlamaLend leads this week's USD yields with over 200% APR on crvUSD deposits in the ynETH/crvUSD market, while the WETH/shezETH Stableswap pool offers over 100% APR ETH yield. Read on for this week's key metrics and opportunities across the Curve ecosystem.

Top Yields

Note: for pools with less than $100k TVL, the yield has been calculated as if the pool has $100k TVL.

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

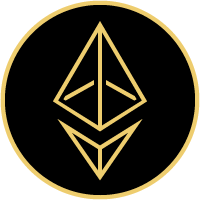

|

sDOLA sDOLA alUSD alUSD |

USD | 69.79% |

|

USD3 USD3 sDAI sDAI |

USD | 29.46% |

|

CrossCurve Stable |

USD | 27.81% |

|

zunBTC zunBTC tBTC tBTC |

BTC | 38.04% |

|

EBTC EBTC tBTC tBTC |

BTC | 4.54% |

|

ShezETH ShezETH WETH WETH |

ETH | 106% |

|

zunETH zunETH frxETH frxETH |

ETH | 13.59% |

|

CRV CRV crvUSD crvUSD |

CRV | 34.4% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 19.73% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 14.73% |

crvUSD & scrvUSD Yield Opportunities

At the time of writing, LlamaLend offers higher yields than all USD stablecoin pools except one. Check below for available opportunities.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD ynETH ynETH |

LlamaLend | 213% |

|

crvUSD crvUSD ARB ARB |

LlamaLend | 39.51% |

|

crvUSD crvUSD ARB ARB |

LlamaLend | 33.02% |

|

crvUSD crvUSD asdCRV asdCRV |

LlamaLend | 32.71% |

|

USD3 USD3 scrvUSD scrvUSD |

Pool | 27.35% |

|

USDC USDC scrvUSD scrvUSD |

Pool | 23.87% |

|

sUSD sUSD crvUSD crvUSD |

Pool | 22.42% |

|

USDM USDM crvUSD crvUSD |

Pool | 19.8% |

Notable Pool Activity

Highest Volume Pools

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$890.6M | $166.3M |

|

USD0 USD0 USDC USDC |

$672M | $101.2M |

|

USD0 USD0 USD0++ USD0++ |

$276.8M | $319.6M |

|

ETH ETH stETH stETH |

$256.3M | $176.5M |

Recently Launched Pools

| Chain | Pool | TVL |

|---|---|---|

|

USDX USDX sUSDX sUSDX |

$1.032M |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

USD0 USD0 USDC USDC |

$134.4k | $672M |

|

USD0 USD0 USD0++ USD0++ |

$110.7k | $276.8M |

|

DAI DAI USDC USDC USDT USDT |

$89.08k | $890.6M |

Most Profitable Pools

Note: Minimum $100k TVL, profitability is measured by fees per $1 of liquidity

| Chain | Pool | Fees | TVL |

|---|---|---|---|

|

USDT USDT EYWA EYWA |

$10.99k | $714.1k |

|

ETH ETH PRISMA PRISMA |

$1.224k | $130.5k |

|

mkUSD mkUSD PRISMA PRISMA |

$2.434k | $335.9k |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

Pool Statistics

| Metric | Value | Change |

|---|---|---|

| TVL | $2.327B | +0.61% |

| Volume | $3.375B | -12.59% |

| Transactions | 350,053 | -22.85% |

| Total Fees | $787k | -14.49% |

| DAO Fees | $393.5k | -14.49% |

crvUSD & scrvUSD Performance

The proportion of crvUSD staked in scrvUSD continues to rise, helping to strengthen the crvUSD peg.

| Metric | Value | Change |

|---|---|---|

crvUSD Supply crvUSD Supply |

$77.55M | -0.30% |

scrvUSD Yield scrvUSD Yield |

15% APY | -0.21% |

crvUSD in crvUSD in scrvUSD scrvUSD |

29.96% | +3.31% |

crvUSD Peg crvUSD Peg |

$0.9993 | +$0.0008 |

crvUSD Loan Metrics

scrvUSD continues to ease borrowing rates downwards, while Curve's automatically fluctuating rates remain slightly higher than competitors, suggesting users value the Liquidation Protection feature enough to pay a premium.

| Metric | Value | Change |

|---|---|---|

| Avg. Borrow Rate | 14.81% | -1.53% |

| crvUSD Borrowed | $77.55M | -0.41% |

| Collateral | $142.2M | +0.92% |

| Loans | 642 | -12 |

| Fees | $201.6k | -15.29% |

| Pegkeeper Debt | $0 | - |

LlamaLend Performance

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $43.68M | -6.37% |

| Supplied | $31.62M | +1.67% |

| Borrowed | $22.36M | -3.37% |

| Collateral | $34.43M | -11.03% |

| Loans | 661 | +13 |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

Risk Advisory: References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.