Curve Best Yields & Key Metrics | Week 11, 2025

Weekly yield and Curve ecosystem metric updates as of the 13th March, 2025

Market Overview

Curve has had a strong week with Llamalend now live on Sonic and three new markets available for crvUSD—check out the full announcement for details.

Total Value Locked (TVL) stands at $1.728B, a slight 5.68% dip amid market fluctuations.

Plenty of attractive yield opportunities are available—explore the latest metrics and earning potential below.

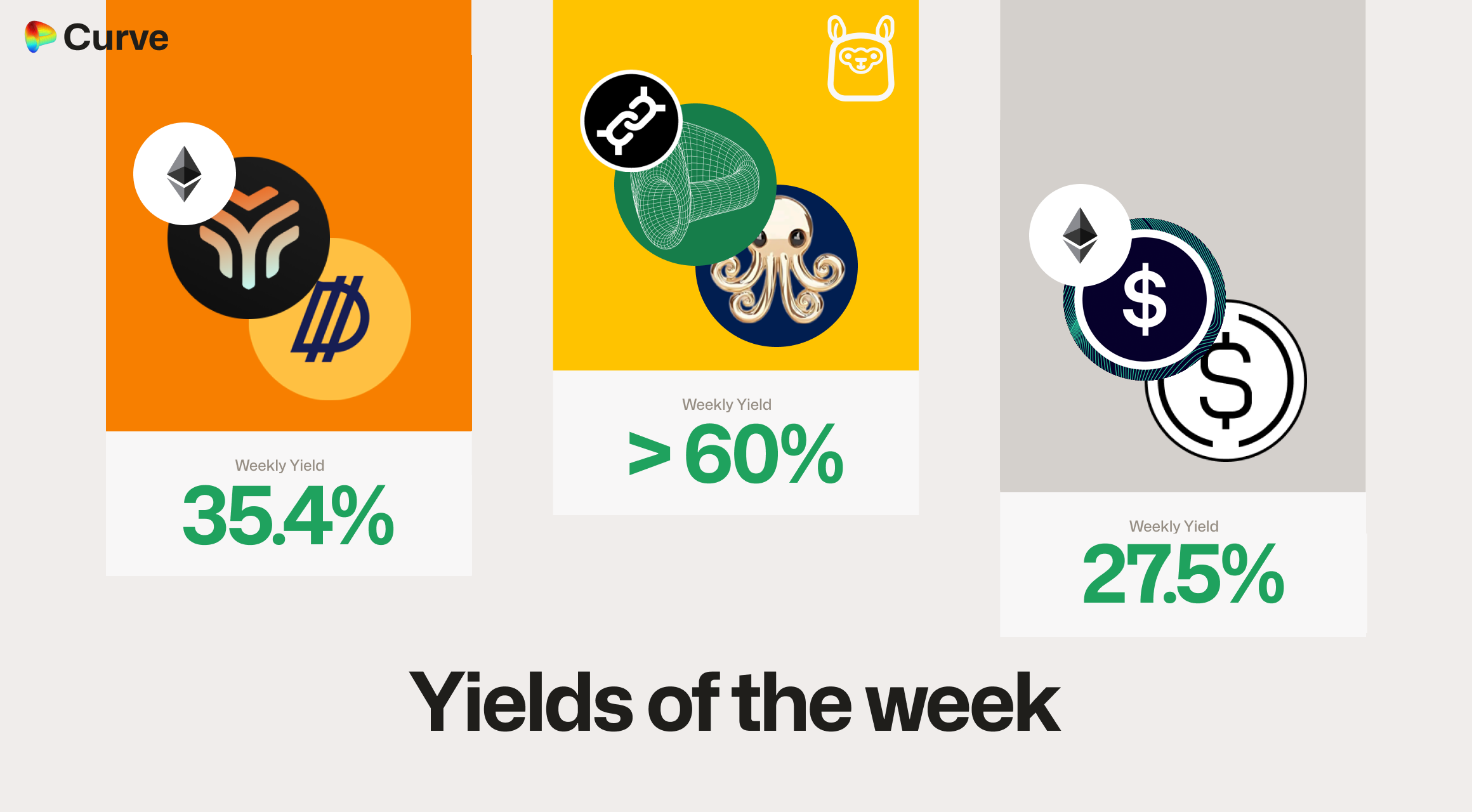

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

yUSD yUSD sDOLA sDOLA |

USD | 35.36% |

|

sUSD sUSD sUSDe sUSDe |

USD | 27.46% |

|

CRV CRV crvUSD crvUSD |

CRV | 26.24% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 24.04% |

|

msETH  WETH WETH |

ETH | 23.23% |

|

dUSD dUSD sUSDe sUSDe |

USD | 18.54% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 14.57% |

|

uniETH uniETH WETH WETH |

ETH | 12.74% |

|

EURA EURA EURC EURC |

EUR | 6.79% |

|

tBTC tBTC WBTC WBTC |

BTC | 5.21% |

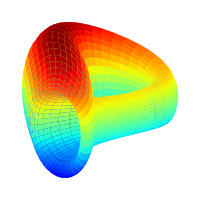

CrvUSD & scrvUSD Yield Opportunities

The crvUSD/SQUID lending market is currently small with $43k supplied with 139% APY, at $100k TVL this market would still be over 60% APY.

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD SQUID SQUID |

LlamaLend | > 60% |

|

scrvUSD scrvUSD sfrxUSD sfrxUSD |

Pool | 15.96% |

|

crvUSD crvUSD USDT USDT |

Pool | 15.83% |

|

frxUSD frxUSD scrvUSD scrvUSD |

Pool | 15.24% |

|

crvUSD crvUSD FXS FXS |

LlamaLend | 14.81% |

|

crvUSD crvUSD USDC USDC |

Pool | 14.51% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

Three new crvUSD minting markets are live this week: cbBTC, weETH, and LBTC. Notably, the weETH market is the first to offer incentives for borrowing crvUSD.

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$61.51M | +7.51% |

scrvUSD Yield scrvUSD Yield |

1.10% APY | -2.72% |

crvUSD in crvUSD in scrvUSD scrvUSD |

28.38% | -4.40% |

crvUSD Peg crvUSD Peg |

$0.99992 | +$0.00001 |

Avg. Borrow Rate Avg. Borrow Rate |

2.492% | +1.98% |

Loans Loans |

635 | -2 |

Fees Fees |

$13.37k | +17.73% |

Pegkeeper Debt Pegkeeper Debt |

$10.16M | -$12.40M |

Pool Statistics

Fees continue to increase, even with lower volumes, driven by optimized dynamic fees in new Curve pools.

| Metric | Value | Change |

|---|---|---|

| TVL | $1.594B | -5.46% |

| Volume | $2.429B | -33.49% |

| Transactions | 395,979 | -9.90% |

| Total Fees | $639.1k | +10.57% |

LlamaLend Performance

Lending TVL dipped this week amid market volatility. With Llamalend now deployed on Sonic, it will be worth watching how this impacts TVL in the coming weeks.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $36.01M | -9.08% |

| Supplied | $30.51M | -6.27% |

| Borrowed | $18.95M | -5.00% |

| Loans | 480 | -77 |

Notable Pool Activity

Highest Volume Pools

The Curve.fi Strategic USD Reserves pool continues to deliver, earning 4.51% APY from fees alone this week—outpacing the US10Y bond. With an additional 2.3% in CRV rewards, it remains one of the most competitive risk/reward yields in DeFi.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$420.2M | $169.7M |

|

ETH ETH stETH stETH |

$273.7M | $96.93M |

|

USDC USDC USDT USDT |

$192.2M | $4.881M |

Recently Launched Pools

Sonic takes the spotlight this week for new pools, with two notable additions surpassing $100K in TVL.

| Chain | Pool | TVL |

|---|---|---|

|

scUSD scUSD USDC.e USDC.e |

$1.1M |

|

CrossCurve CRV |

$223.2k |

Highest Fee Generating Pools

The 3Pool remains the top fee-generating pool this week, with all fees now flowing to the CurveDAO.

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$84.08k | $420.2M |

|

USDT USDT WBTC WBTC WETH WETH |

$57.56k | $23.08M |

|

msUSD  FRAXBP FRAXBP |

$50.57k | $126.4M |

Top Organic Yielding Pools

Metronome's msETH and msUSD pools generated the highest fees per $1 of TVL this week, making them the most profitable organic yield for LPs.

| Chain | Pool | Org. APY | Fees | TVL |

|---|---|---|---|---|

|

msETH  WETH WETH |

48.6% | $47.1k | $3.28M |

|

msUSD  FRAXBP FRAXBP |

36.7% | $50.6k | $5.41M |

|

msETH  frxETH frxETH |

25.9% | $7.10k | $718k |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.