Curve Best Yields & Key Metrics | Week 12, 2025

Weekly yield and Curve ecosystem metric updates as of the 20th March, 2025

Market Overview

It’s been a strong week for yields at Curve, with many pools and lending markets offering very attractive returns.

TVL has risen 4.63% to $1.808B. Meanwhile, Convex and Yearn's Resupply protocol went live launched an hour ago, directly incentivizing supply to Llamalend markets. Its impact on the ecosystem will be worth watching in the coming weeks.

This update highlights the most compelling opportunities across the Curve ecosystem—see below for top yields and weekly metrics.

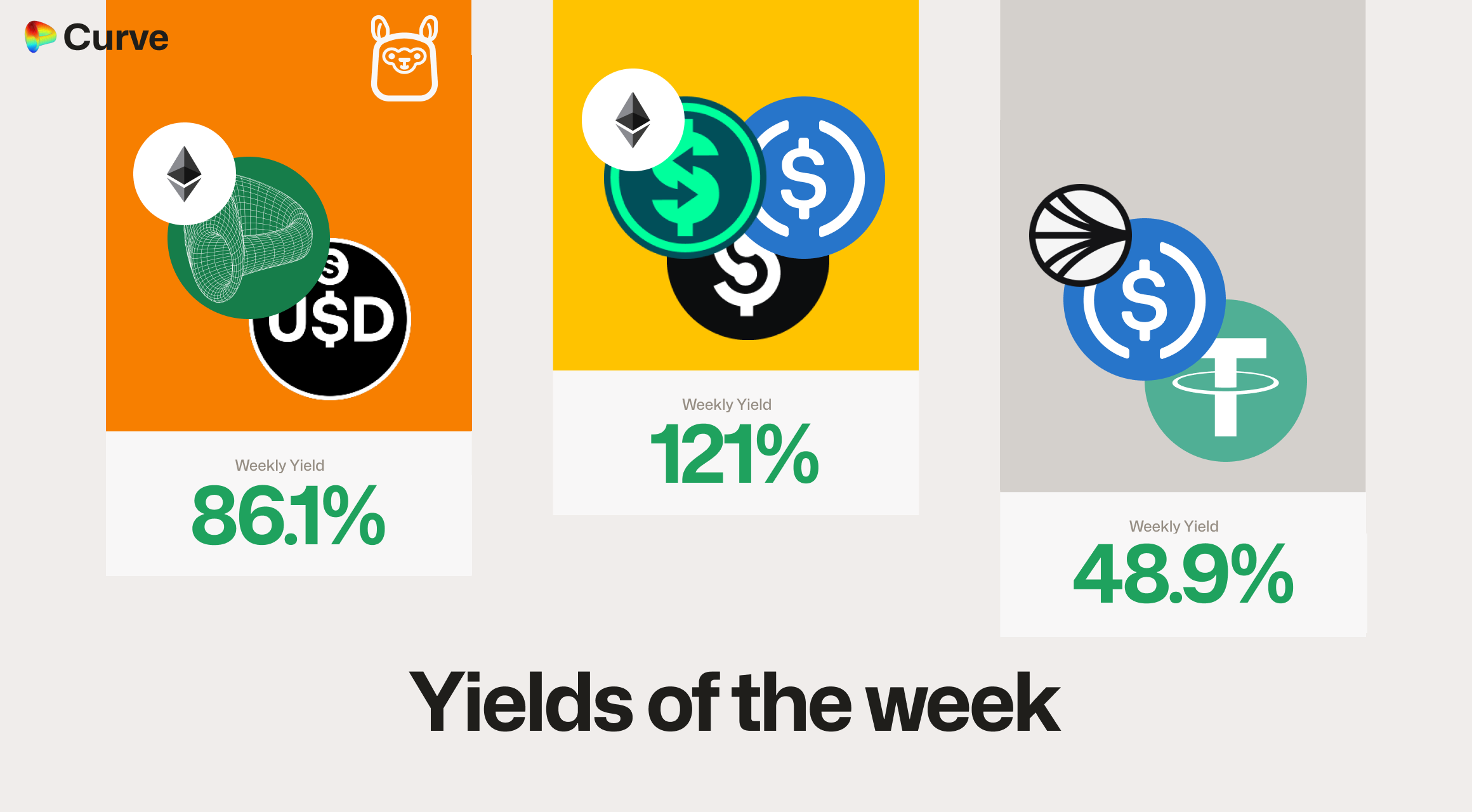

Top Yields

Note: for pools and lending markets with less than $100k TVL, the yield has been calculated as if the pool has $100k TVL.

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

rgUSD rgUSD eUSD eUSD USDC USDC |

USD | 121% |

|

USDT USDT USDC.e USDC.e |

USD | 48.9% |

|

CRV CRV crvUSD crvUSD |

CRV | 25.8% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 21.2% |

|

eUSD eUSD FRAXBP FRAXBP |

USD | 18.3% |

|

msETH  WETH WETH |

ETH | 16.1% |

|

wstETH wstETH wfrxETH wfrxETH |

ETH | 14.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 7.25% |

|

crvUSD crvUSD tBTC tBTC wstETH wstETH |

TRICRYPTO | 6.75% |

|

WBTC WBTC tBTC tBTC |

BTC | 4.04% |

CrvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD sfrxUSD sfrxUSD |

LlamaLend | 86.1% |

|

crvUSD crvUSD wstETH wstETH |

LlamaLend | 44.0% |

|

crvUSD crvUSD WBTC WBTC |

LlamaLend | 35.5% |

|

crvUSD crvUSD WETH WETH |

LlamaLend | 34.7% |

|

crvUSD crvUSD SQUID SQUID |

LlamaLend | 29.2% |

|

crvUSD crvUSD sUSDe sUSDe |

LlamaLend | 15.6% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$61.07M | -0.72% |

scrvUSD Yield scrvUSD Yield |

1.85% APY | +0.75% |

crvUSD in crvUSD in scrvUSD scrvUSD |

31.35% | +2.97% |

crvUSD Peg crvUSD Peg |

$1.00006 | +$0.00014 |

Avg. Borrow Rate Avg. Borrow Rate |

2.318% | -0.17% |

Loans Loans |

646 | +11 |

Fees Fees |

$34.04k | +154.58% |

Pegkeeper Debt Pegkeeper Debt |

$10.51M | +346.6k |

Pool Statistics

As volatility eases, volume and fees have declined. However, TVL has risen by 4%—a promising sign.

| Metric | Value | Change |

|---|---|---|

| TVL | $1.662B | +4.27% |

| Volume | $1.419B | -41.57% |

| Transactions | 350,850 | -11.40% |

| Total Fees | $304.8k | -52.32% |

LlamaLend Performance

Llamalend is gradually gaining traction, with further growth possible as Convex and Yearn's Resupply protocol goes live. It will be worth watching how usage evolves in the coming weeks.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $36.67M | +1.84% |

| Supplied | $30.39M | -0.40% |

| Borrowed | $19.01M | +0.31% |

| Loans | 497 | +17 |

Notable Pool Activity

Highest Volume Pools

A new volume leader emerged this week: Elixir's deUSD/USDC pool (with deUSD backed by BlackRock's BUIDL Fund), generating over $220M in volume from just $6M in TVL.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

deUSD deUSD USDC USDC |

$220.5M | $6.798M |

|

USDC USDC USDT USDT |

$161.2M | $4.344M |

|

DAI DAI USDC USDC USDT USDT |

$160.7M | $171.5M |

Recently Launched and Resurrected Pools

Five notable pools launched this week, and the USDC/USDT pool on Ethereum has been revived after nearly three years—jumping from just $260 in TVL last week to $522K this week, driven solely by CRV incentive votes.

| Chain | Pool | TVL |

|---|---|---|

|

ELX ELX stELX stELX |

$3.71M |

|

USDC USDCUSDf |

$1.00M |

|

USDC USDC USDT USDT |

$99.2k |

|

rgUSD rgUSD eUSD eUSD USDC USDC |

$133k |

|

USDT USDT USDC.e USDC.e |

$62.0k |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

USD0 USD0 USD0++ USD0++ |

$33.52k | $83.82M |

|

DAI DAI USDC USDC USDT USDT |

$32.14k | $160.7M |

|

deUSD deUSD USDC USDC |

$22.08k | $220.5M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.