Curve Best Yields & Key Metrics | Week 15, 2025

Weekly yield and Curve ecosystem metric updates as of the 10th April, 2025

Market Overview

This week, markets have experienced significant volatility. While the DeFi sector as a whole lost 4.72%, Curve has held up relatively well, declining by only 2.07% and currently sitting at a TVL of $1.795 billion.

As always, Curve offers some great opportunities for yield, along with many promising metrics emerging from Llamalend markets and the growing crvUSD supply.

This weekly update highlights the most compelling opportunities across the Curve ecosystem.

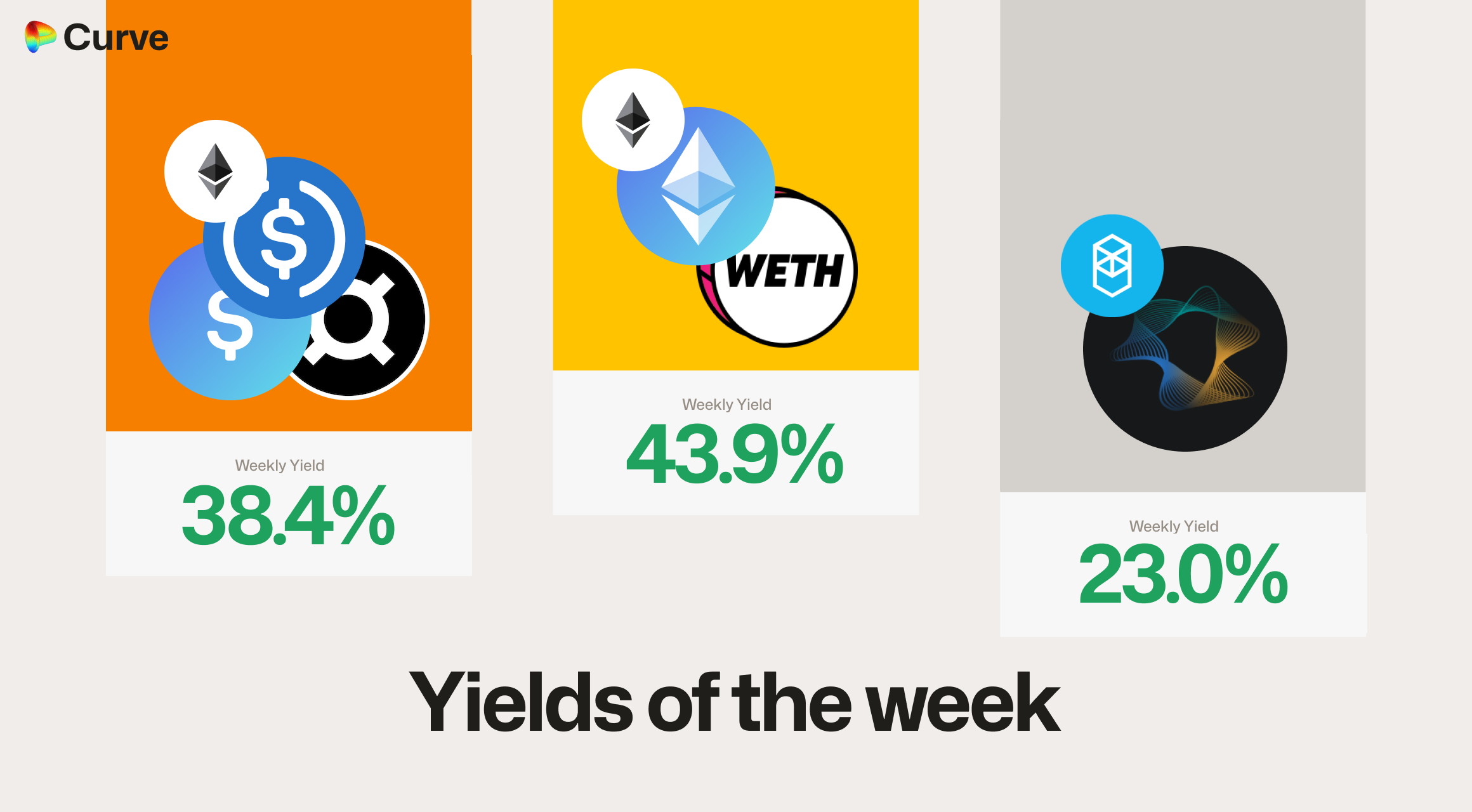

Top Yields

Note: for pools with less than $100k TVL, the yield has been calculated as if the pool has $100k TVL.

Top USD Stablecoin Yields

| Chain | Market | Type | Yield |

|---|---|---|---|

|

msUSD msUSD FRAX FRAX USDC USDC |

Pool | 38.4% |

|

CrossCurve Stable 3 CrossCurve Stable 3 |

Pool | 22.0% |

|

Bold Bold LUSD LUSD |

Pool | 21.3% |

|

frxUSD frxUSD sUSDe sUSDe |

Pool | 19.7% |

|

CrossCurve Stable CrossCurve Stable |

Pool | 19.1% |

|

crvUSD crvUSD SQUID SQUID |

LlamaLend | 18.6% |

|

crvUSD crvUSD asdCRV asdCRV |

LlamaLend | 17.0% |

|

crvUSD crvUSD FXS FXS |

LlamaLend | 15.7% |

Top Alternative Asset Yields

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

msETH msETH WETH WETH |

ETH | 43.9% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 21.8% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 19.3% |

|

CrossCurve ETH 2 CrossCurve ETH 2 |

ETH | 18.9% |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

TRICRYPTO | 17.7% |

|

uniETH uniETH WETH WETH |

ETH | 15.9% |

|

EURA EURA EURC EURC |

EUR | 8.1% |

|

LBTC LBTC WBTC WBTC |

BTC | 6.8% |

|

EBTC EBTC tBTC tBTC |

BTC | 6.8% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

The crvUSD supply continues to grow week over week due to strong demand, and CurveDAO is now earning solid weekly fees as the borrow rate begins to rise once again.

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$106.5M | +16.32% |

scrvUSD Yield scrvUSD Yield |

3.16% APY | +0.94% |

crvUSD in crvUSD in scrvUSD scrvUSD |

21.99% | -1.43% |

crvUSD Peg crvUSD Peg |

$1.0002 | +$0.0002 |

Avg. Borrow Rate Avg. Borrow Rate |

3.99% | +3.66% |

Loans Loans |

664 | -54 |

Fees Fees |

$67.84k | +178.9% |

Pegkeeper Debt Pegkeeper Debt |

$11.59M | -$32.12M |

Pool Statistics

High volatility is always good for boosting volume and fees, and this week is no different. Both the CurveDAO and liquidity providers are seeing strong revenue from the total pool fees collected.

| Metric | Value | Change |

|---|---|---|

| TVL | $1.573B | -2.96% |

| Volume | $2.449B | +44.48% |

| Transactions | 427,060 | +18.14% |

| Total Fees | $649.3k | +68.73% |

LlamaLend Performance

Thanks to Resupply boosting available liquidity in Llamalend markets, borrowers have begun tapping into the newly available cheap liquidity.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $104.8M | +9.59% |

| Supplied | $93.92M | +8.31% |

| Borrowed | $44.88M | +30.76% |

| Loans | 527 | -125 |

Notable Pool Activity

Highest Volume Pools

Strong demand for crvUSD has propelled a crvUSD pool into the top three by volume this week — a great sign of momentum.

| Chain | Pool | TVL | Volume |

|---|---|---|---|

|

ETH ETH stETH stETH |

$84.84M | $339.7M |

|

DAI DAI USDC USDC USDT USDT |

$173.9M | $260.3M |

|

USDC USDC crvUSD crvUSD |

$15.99M | $104.3M |

Highest Fee Generating Pools

| Chain | Pool | Volume | Fees |

|---|---|---|---|

|

USDT USDT WBTC WBTC WETH WETH |

$35.95M | $71.27k |

|

DAI DAI USDC USDC USDT USDT |

$260.3M | $51.87k |

|

USD0 USD0 USD0++ USD0++ |

$94.90M | $37.96k |

Most Profitable Pools for Trading Yield

Metronome’s synth pools make up two of the three most profitable pools this week.

| Chain | Pool | TVL | Trading APY |

|---|---|---|---|

|

msETH msETH WETH WETH |

$2.824M | 41.0% |

|

WETH WETH INV INV |

$586.2k | 31.0% |

|

msUSD msUSD FRAX FRAX USDC USDC |

$4.06M | 29.6% |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.