Curve Best Yields & Key Metrics | Week 2, 2025

Weekly yield and Curve ecosystem metric updates as of the 10rd January, 2025

Market Overview

Despite market volatility, Curve has demonstrated its resilience. Curve's innovative loan protection system has effectively preserved borrower collateral in this high volatility, while TVL has adjusted modestly to 2.382B amid broader market price decreases.

In this environment, Curve continues to stand out - offering attractive yield opportunities alongside increasingly competitive borrowing rates, driven by scrvUSD's innovative mechanics.

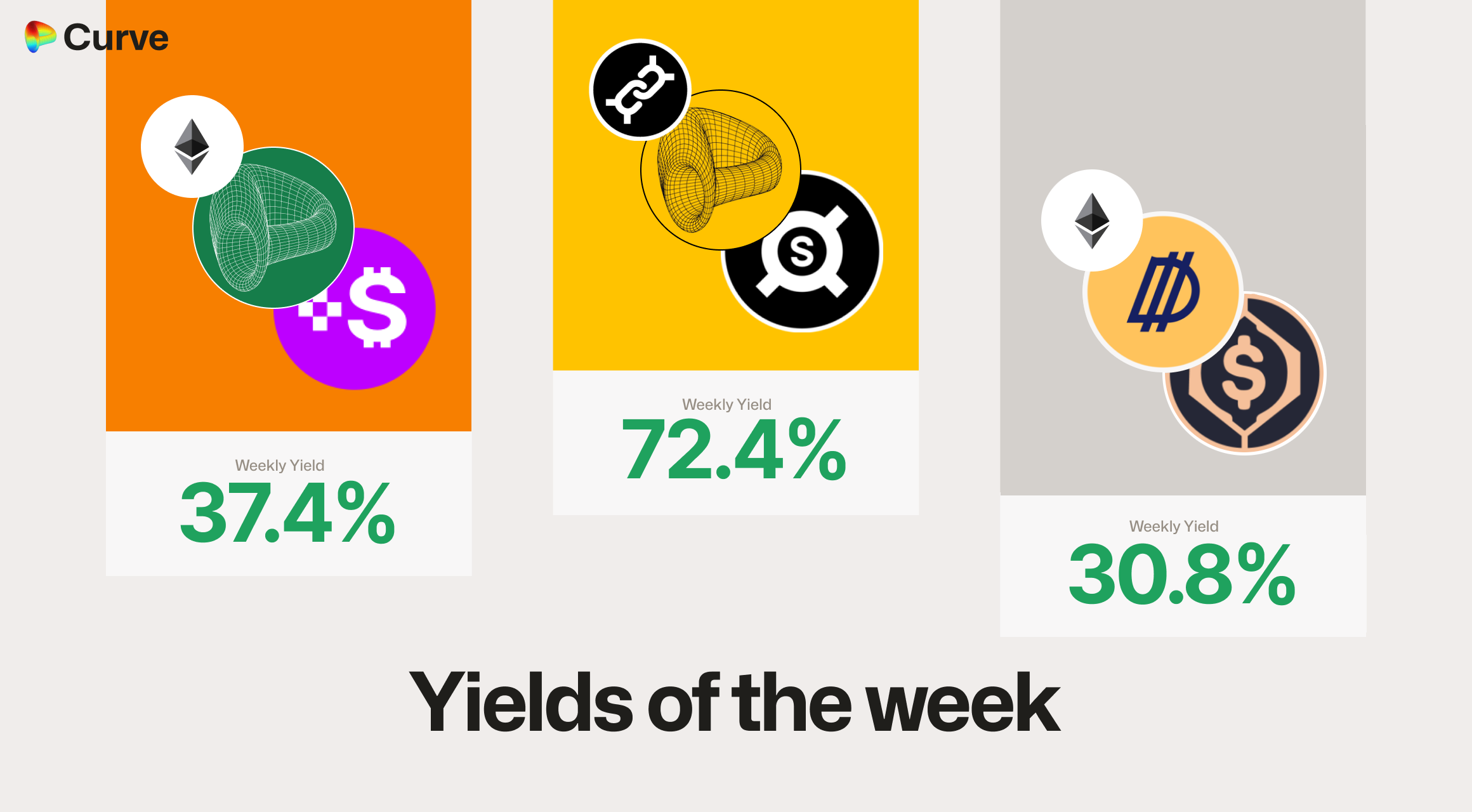

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD sFRAX sFRAX |

USD | 72.37% |

|

thUSD thUSD crvUSD crvUSD |

USD | 37.4% |

|

sDOLA sDOLA alUSD alUSD |

USD | 30.75% |

|

zunBTC zunBTC tBTC tBTC |

BTC | 15.94% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 6.24% |

|

frxETH frxETH OETH OETH |

ETH | 32.62% |

|

zunETH zunETH frxETH frxETH |

ETH | 13.58% |

|

CRV CRV crvUSD crvUSD |

CRV | 29.85% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 21.1% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 13.57% |

CrvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD sFRAX sFRAX |

Pool | 72.37% |

|

thUSD thUSD crvUSD crvUSD |

Pool | 37.4% |

|

crvUSD crvUSD CRV CRV |

LlamaLend | 30.7% |

|

crvUSD crvUSD WETH WETH |

LlamaLend | 28.68% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

CrvUSD has demonstrated exceptional stability, with less than 1% supply reduction and maintaining strong peg performance throughout the market downturn. The sustained high demand for crvUSD during this period signals its emerging potential as a market safe haven.

| Metric | Value | Change |

|---|---|---|

crvUSD Supply crvUSD Supply |

$76.89M | -0.85% |

scrvUSD Yield scrvUSD Yield |

12.8% APY | -2.20% |

crvUSD in crvUSD in scrvUSD scrvUSD |

33.48% | +3.52% |

crvUSD Peg crvUSD Peg |

$0.9995 | +$0.0002 |

Pool Statistics

Note: Pool metrics are measured from Thursday 00:00 UTC to Thursday 00:00 UTC. High activity from the past two days will be reflected in next week's statistics.

| Metric | Value | Change |

|---|---|---|

| TVL | $2.239B | -3.78% |

| Volume | $2.699B | -20.02% |

| Transactions | 313,325 | -10.49% |

| Total Fees | $783.4k | -0.45% |

| DAO Fees | $391.7k | -0.45% |

CrvUSD Loan Metrics

PegKeepers have been activated for the first time since scrvUSD launch, responding to crvUSD trading above peg. When this happens, PegKeepers sell allocated crvUSD to restore peg, temporarily taking on debt. They later repay this debt by buying back crvUSD below peg, with profits flowing to CurveDAO. Currently, $2.221M of crvUSD has been sold above peg by PegKeepers, awaiting lower prices for them to buyback.

Despite recent volatility, only 20 loans triggered liquidation protection (soft-liquidation) measures, with just a single full liquidation - demonstrating the robustness of Curve's lending system.

| Metric | Value | Change |

|---|---|---|

| Avg. Borrow Rate | 12.18% | -2.79% |

| crvUSD Borrowed | $76.89M | -0.85% |

| Collateral | $138.6M | -2.53% |

| Loans | 643 | +1 |

| Fees | $209.7k | +4.03% |

| Pegkeeper Debt | $2.221M | +$2.221M |

| Protection-triggered Loans | 20 | |

| Liquidated Loans | 1 |

LlamaLend Performance

This week's volatility provided a valuable stress test for Llamalend's loan performance. While Llamalend is designed for higher volatility markets than crvUSD loans, the system performed exceptionally well: fewer than 10% of borrowers reached their loan protection threshold, with only 6 full liquidations. The median daily protection loss stayed at just 2.04%, highlighting the advantages of Curve's lending infrastructure.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $41.72M | -4.48% |

| Supplied | $31.93M | +0.97% |

| Borrowed | $22.32M | -0.18% |

| Collateral | $32.12M | -6.71% |

| Loans | 664 | +3 |

| Protection-triggered Loans | 55 | |

| Daily Median Protection Loss | 2.04% | |

| Liquidated Loans | 6 |

Notable Pool Activity

Note: Pool metrics are measured from Thursday 00:00 UTC to Thursday 00:00 UTC. High activity from the past two days will be reflected in next week's statistics.

Highest Volume Pools

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$585.4M | $163M |

|

USD0 USD0 USDC USDC |

$394.5M | $96.82M |

|

USDe USDe USDC USDC |

$217.9M | $12.61M |

|

USR USR USDC USDC |

$216.1M | $26.73M |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

am3CRV am3CRV amWBTC amWBTC amWETH amWETH |

$98.81k | $7.932M |

|

USR USR USDC USDC |

$86.35k | $216.1M |

|

USD0 USD0 USDC USDC |

$78.89k | $394.5M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

Risk Advisory: References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.