Curve Best Yields & Key Metrics | Week 4, 2025

Weekly yield and Curve ecosystem metric updates as of the 24th January, 2025

Market Overview

This week, Curve's TVL has moderated to $2.355B, down 2.7% since last week due to the recent volatility in the markets.

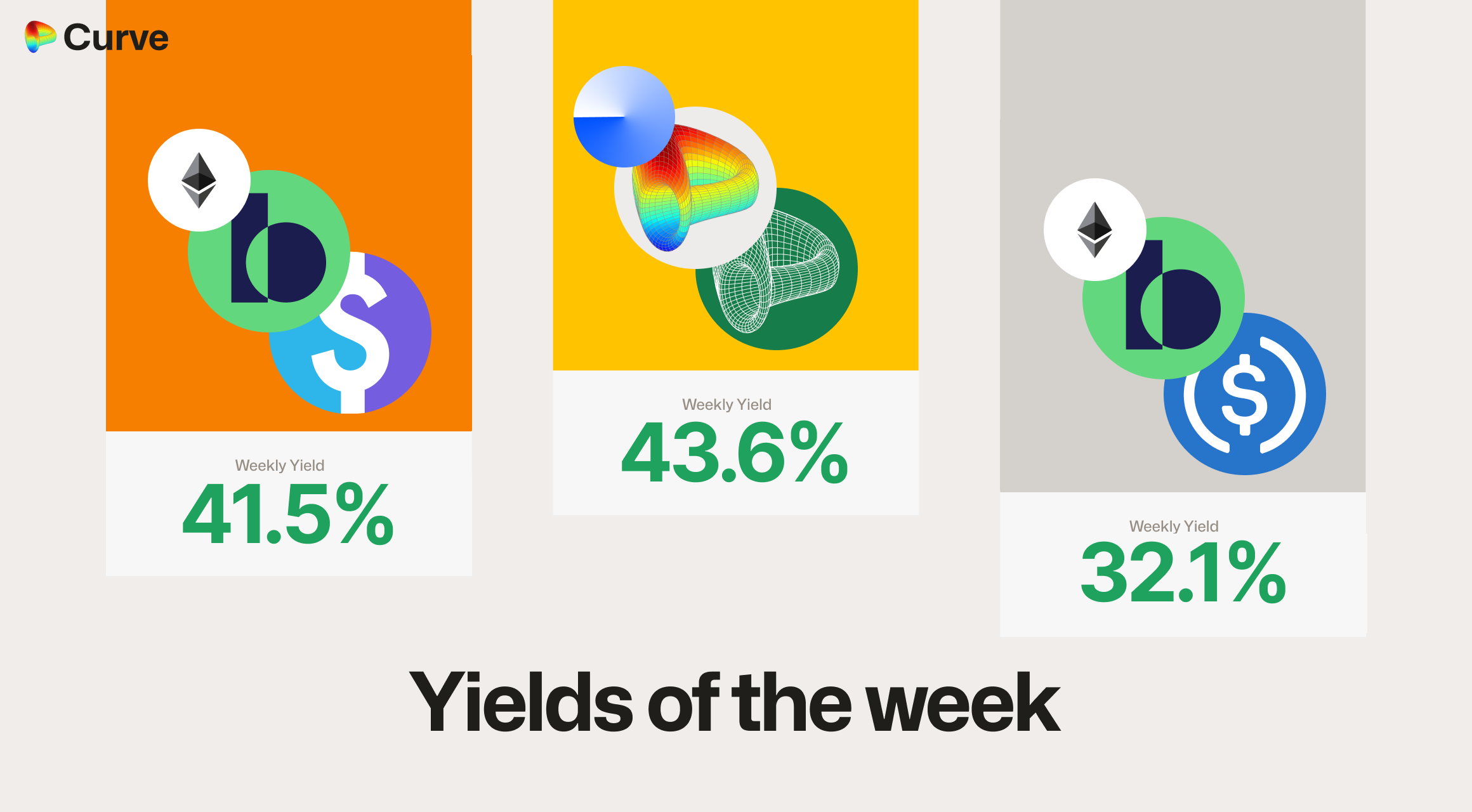

The biggest addition has been the launch of Liquity v2 and their new Bold pools. Attracting almost $10M of TVL in the past 24hrs, and offering the best USD yields of the week at over 40%!

These opportunities and more are shown below in this weekly roundup of the best yields and metrics for the Curve ecosystem.

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

CRV CRV crvUSD crvUSD |

CRV | 43.59% |

|

Bold Bold LUSD LUSD |

USD | 41.48% |

|

Bold Bold USDC USDC |

USD | 32.08% |

|

frxETH frxETH OETH OETH |

ETH | 30.68% |

|

CrossCurve Stable 2 |

USD | 26.72% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 25.18% |

|

stETH stETH wBETH wBETH |

ETH | 21.22% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 12.99% |

|

zunBTC zunBTC tBTC tBTC |

BTC | 5.27% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 3.47% |

crvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD sFRAX sFRAX |

Pool | 22.72% |

|

crvUSD crvUSD tBTC tBTC |

LlamaLend | 21.77% |

|

USDP USDP crvUSD crvUSD |

Pool | 21.54% |

|

crvUSD crvUSD WBTC WBTC |

LlamaLend | 20.93% |

|

crvUSD crvUSD ARB ARB |

LlamaLend | 20.33% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

crvUSD & scrvUSD Performance

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$79.64M | -4.44% |

scrvUSD Yield scrvUSD Yield |

6.33% APY | -0.34% |

crvUSD in crvUSD in scrvUSD scrvUSD |

28.36% | -7.10% |

crvUSD Peg crvUSD Peg |

$0.9995 | -$0.0003 |

Pool Statistics

Volumes and transactions increased a substantial amount across the week!

| Metric | Value | Change |

|---|---|---|

| TVL | $2.14B | -5.56% |

| Volume | $4.206B | +15.72% |

| Transactions | 401,946 | +12.30% |

| Total Fees | $907.5k | -6.47% |

| DAO Fees | $453.7k | -6.47% |

CrvUSD Loan Metrics

Borrowing rates for crvUSD are once again close to average DeFi market rates, while PegKeepers now again hold no debt. However, importantly, the supply of crvUSD is still on an upward trajectory in the long term.

| Metric | Value | Change |

|---|---|---|

| Avg. Borrow Rate | 9.266% | +5.62% |

| crvUSD Borrowed | $79.64M | -4.44% |

| Collateral | $159.3M | -2.67% |

| Loans | 692 | +5 |

| Fees | $104.7k | +38.18% |

| Pegkeeper Debt | $0 | -$7.614M |

LlamaLend Performance

It's great to see that the amount borrowed from LlamaLend has increased by almost 6%, even when the amount of loans has slightly decreased. Perhaps users migrated to LlamaLend, and away from crvUSD, now that the borrowing rates have increased from last week's lows? There are definitely many opportunities for great borrowing rates in LlamaLend.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $46.25M | -1.24% |

| Supplied | $36.25M | +2.39% |

| Borrowed | $25.12M | +5.98% |

| Collateral | $35.12M | -0.03% |

| Loans | 658 | -6 |

Notable Pool Activity

Highest Volume Pools

It was a huge week for volumes, with the 3pool doing over $1.3B of volume!

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$1.353B | $163.7M |

|

ETH ETH stETH stETH |

$484.2M | $168.1M |

|

USD0 USD0 USDC USDC |

$334.9M | $61.94M |

|

USDe USDe USDC USDC |

$255.9M | $10.05M |

Recently Launched Pools

It's great to see the Bold pools getting over $9M of TVL in less than 24hrs since the launch of the Liquity v2.

| Chain | Pool | TVL |

|---|---|---|

|

Bold Bold USDC USDC |

$7.99M |

|

Bold Bold LUSD LUSD |

$1.24M |

|

lvlUSD lvlUSD slvlUSD slvlUSD |

$87.7k |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$135.3k | $1.353B |

|

USR USR USDC USDC |

$71.36k | $178.4M |

|

USD0 USD0 USDC USDC |

$66.97k | $334.9M |

|

USDT USDT WBTC WBTC WETH WETH |

$54.31k | $22.83M |

Most Profitable Pools

Note: Minimum $100k TVL, profitability is measured by fees per $1 of liquidity

| Chain | Pool | Fees | TVL |

|---|---|---|---|

|

WETH WETH ASF ASF |

$5.327k | $1.193M |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

$10.45k | $2.468M |

|

crvUSD crvUSD tBTC tBTC WETH WETH |

$4.279k | $1.25M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

Risk Advisory: References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.