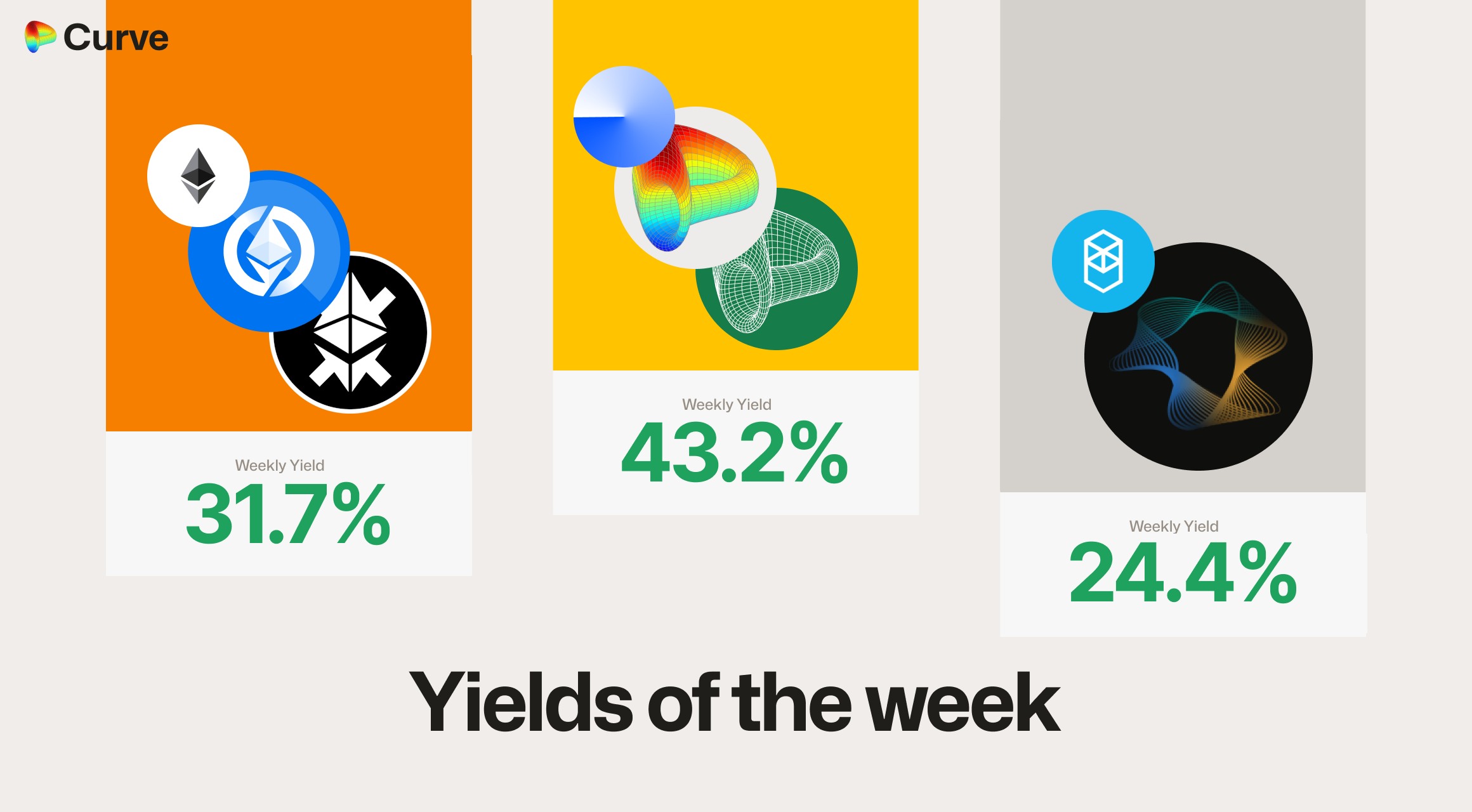

Curve Best Yields & Key Metrics | Week 5, 2025

Weekly yield and Curve ecosystem metric updates as of the 31th January, 2025

Market Overview

Today Curve's TVL stands at $2.326B, dropping 1.23% from last week - showing impressive stability compared to the broader DeFi market's steeper 3.67% decline during this tumultuous time.

This week, there are some great opportunities for users with quick fingers. This update coincides with the release of the incentives for Curve pools on Taiko. While exact yields can't be estimated, initial 24-hour rewards are expected to be significant. We will have a special section to link to these pools below.

As always, this weekly update highlights the most compelling opportunities and metrics across the Curve ecosystem. Check out everything below.

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

CRV CRV crvUSD crvUSD |

CRV | 43.18% |

|

frxETH frxETH OETH OETH |

ETH | 31.7% |

|

CrossCurve Stable 2 |

USD | 24.38% |

|

sDOLA sDOLA alUSD alUSD |

USD | 23.13% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 22.45% |

|

FRAX FRAX PYUSD PYUSD |

USD | 22.14% |

|

CrossCurve ETH 2 |

ETH | 19.49% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 12.72% |

|

EBTC EBTC tBTC tBTC |

BTC | 3.79% |

|

tBTC tBTC cbBTC cbBTC |

BTC | 3.38% |

CrvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

scrvUSD scrvUSD sFRAX sFRAX |

Pool | 21.01% |

|

USDC USDC scrvUSD scrvUSD |

Pool | 20.01% |

|

crvUSD crvUSD ARB ARB |

LlamaLend | 19.24% |

|

crvUSD crvUSD WETH WETH |

LlamaLend | 19.11% |

|

crvUSD crvUSD WBTC WBTC |

LlamaLend | 18.97% |

|

crvUSD crvUSD CRV CRV |

LlamaLend | 18.22% |

Curve pools on Taiko

TAIKO liquidity incentives have launched for Curve Pools on Taiko! These team-issued incentives will be ongoing - join early to maximize your yield farming returns.

| Chain | Pool | TVL | Est. Yield |

|---|---|---|---|

|

USDC USDC USDT USDT |

503.9k | 20% - 40% |

|

crvUSD crvUSD USDC USDC |

114.7k | 18% - 36% |

|

crvUSD crvUSD USDT USDT |

100.7k | 18% - 36% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

96.29k | 27% - 54% |

|

crvUSD crvUSD CRV CRV TAIKO TAIKO |

91.31k | 27% - 54% |

|

crvUSD crvUSD scrvUSD scrvUSD |

4.21k | 18% - 36% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

CrvUSD & scrvUSD Performance

The peg is strong. CrvUSD is working exactly as it should. Now that the yield has once again increased after last week's slump, the staking ratio of crvUSD has risen once again.

This has led to crvUSD going slightly above peg, which wakes the PegKeepers, and lowers the average borrow rate. These interconnected mechanisms are stabilizing and dampening interest rate fluctuations. The systems are working. Curve has never been a better place to borrow from.

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$77.32M | -2.91% |

scrvUSD Yield scrvUSD Yield |

9.2% APY | +2.87% |

crvUSD in crvUSD in scrvUSD scrvUSD |

35.16% | +6.80% |

crvUSD Peg crvUSD Peg |

$0.9995 | - |

Avg. Borrow Rate Avg. Borrow Rate |

7.678% | -1.59% |

Loans Loans |

699 | +7 |

Fees Fees |

$141.2k | +34.87% |

Pegkeeper Debt Pegkeeper Debt |

$8.428M | +$8.428M |

Pool Statistics

Curve Pool volumes have naturally eased as markets cool and volatility decreased following the U.S. presidential inauguration.

| Metric | Value | Change |

|---|---|---|

| TVL | $2.137B | -0.14% |

| Volume | $3.054B | -27.38% |

| Transactions | 381,146 | -5.17% |

| Total Fees | $668.6k | -26.32% |

| DAO Fees | $334.3k | -26.32% |

LlamaLend Performance

LlamaLend is showing some positive signs, with all metrics in the green even with the DeFi TVL broadly reducing.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $47M | +1.63% |

| Supplied | $36.8M | +1.52% |

| Borrowed | $25.19M | +0.27% |

| Loans | 661 | +3 |

Notable Pool Activity

Highest Volume Pools

The DAI/USDC/USDT Pool on Ethereum continues to perform, accounting for over $1B in volume for the week.

However, the utilization of liquidity in the USDe/USDC Pool on Ethereum shows remarkable efficiency, achieving over $200M in volume with just $10M of liquidity.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$1.009B | $164M |

|

ETH ETH stETH stETH |

$278M | $164.3M |

|

USDe USDe USDC USDC |

$207.9M | $10.26M |

Recently Launched Pools

The WBTC/IBTC Pool has achieved over $1M of liquidity after only 1 week, with no incentives.

| Chain | Pool | TVL |

|---|---|---|

|

WBTC WBTC IBTC IBTC |

$1.014M |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$100.9k | $1.009B |

|

USR USR USDC USDC |

$59.33k | $148.4M |

|

WETH WETH AIOZ AIOZ |

$36.36k | $9.332M |

|

USDT USDT WBTC WBTC WETH WETH |

$35.19k | $21.82M |

Most Profitable Pools

Note: Minimum $100k TVL, profitability is measured by fees per $1 of liquidity

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.