Curve Best Yields & Key Metrics | Week 7, 2025

Weekly yield and Curve ecosystem metric updates as of the 14th February, 2025

Market Overview

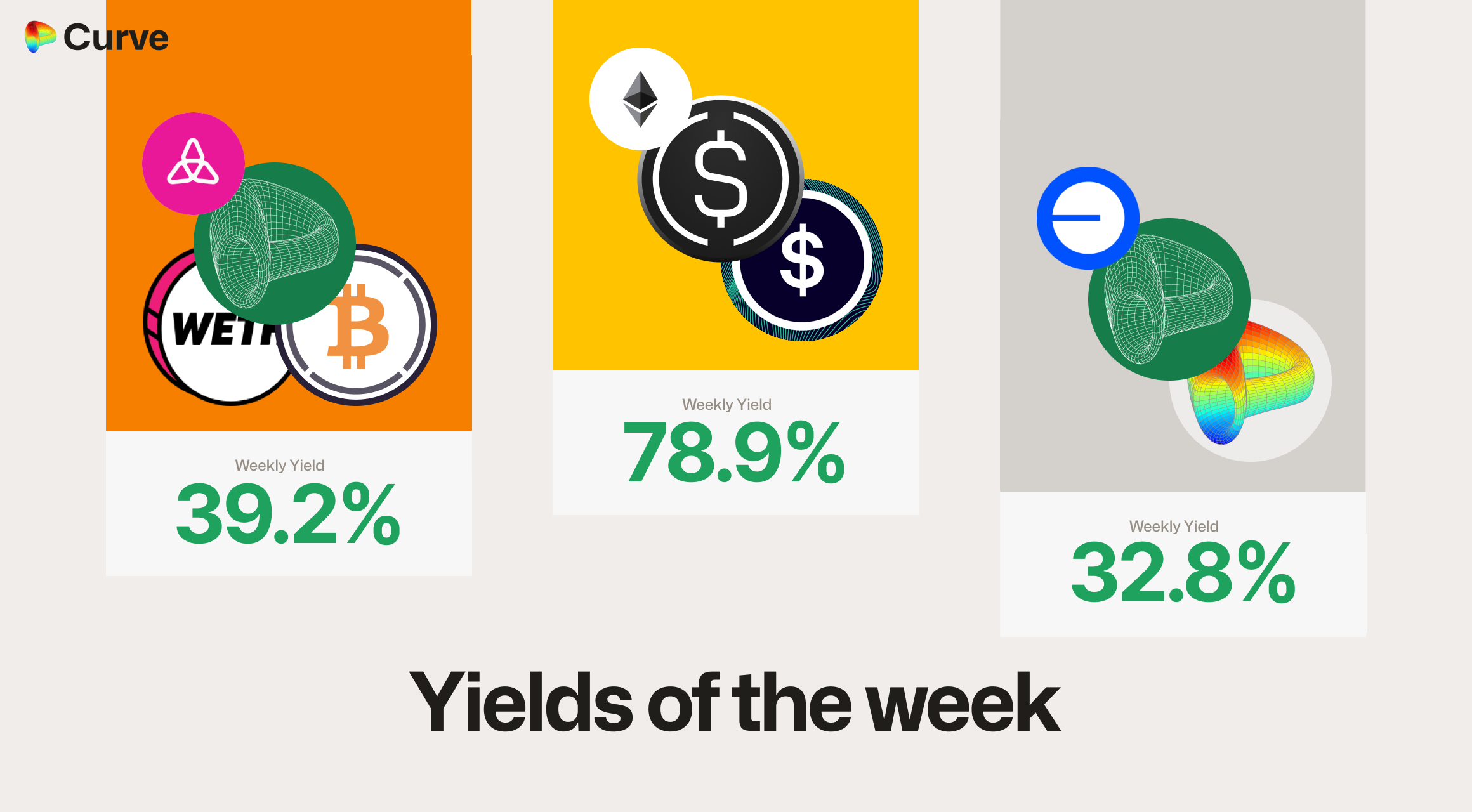

As always Curve continues to offer compelling yield opportunities across its ecosystem. This week's standout returns include a remarkable 78% yield on USD stablecoins and 44% APY in a diversified pool combining USD, ETH, and BTC exposure on Taiko.

While Curve's total value locked (TVL) experienced a modest 2% decline to $2.048B, green shoots are emerging within the ecosystem. Most notably, the Curve.fi Strategic USD Reserve pool has demonstrated impressive performance. The pool has achieved $50M in trading volume with just $5M TVL in the past 24 hours, and is generating approximately 7% organic yield from trading fees alone. Given this success, in the coming weeks we may see more Curve.fi Strategic Reserves.

This weekly update explores these opportunities and other key metrics, showcasing how Curve maintains its position as a leading DeFi yield protocol.

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

sUSD sUSD USDe USDe |

USD | 78.82% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 44.67% |

|

CRV CRV crvUSD crvUSD |

CRV | 32.77% |

|

crvUSD crvUSD scrvUSD scrvUSD |

USD | 32.46% |

|

DOLA DOLA sdeUSD sdeUSD |

USD | 31.06% |

|

zunBTC zunBTC tBTC tBTC |

BTC | 28.54% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 26.57% |

|

uniETH uniETH WETH WETH |

ETH | 19.35% |

|

uniETH uniETH WETH WETH |

ETH | 18.48% |

|

EURA EURA EURT EURT EURS EURS |

EUR | 7.93% |

|

EBTC EBTC tBTC tBTC |

BTC | 4.22% |

crvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD scrvUSD scrvUSD |

Pool | 32.46% |

|

crvUSD crvUSD USDC USDC |

Pool | 28.83% |

|

crvUSD crvUSD USDT USDT |

Pool | 28.12% |

|

MIM MIM crvUSD crvUSD |

Pool | 25.25% |

|

crvUSD crvUSD WETH WETH |

LlamaLend | 22.23% |

|

crvUSD crvUSD WETH WETH |

LlamaLend | 21.36% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

Following last week's market volatility, Curve has seen a natural cooling of both trading volumes and fees, which is typical in the aftermath of major liquidation events.

crvUSD & scrvUSD Performance

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$71.11M | -2.93% |

scrvUSD Yield scrvUSD Yield |

7.58% APY | +4.15% |

crvUSD in crvUSD in scrvUSD scrvUSD |

26.54% | -6.72% |

crvUSD Peg crvUSD Peg |

$0.9998 | - |

Avg. Borrow Rate Avg. Borrow Rate |

10.42% | +7.41% |

Loans Loans |

648 | -13 |

Fees Fees |

$105.4k | +144.74% |

Pegkeeper Debt Pegkeeper Debt |

$104.8k | -7.281M |

Pool Statistics

| Metric | Value | Change |

|---|---|---|

| TVL | $1.882B | -2.84% |

| Volume | $2.211B | -31.39% |

| Transactions | 392,805 | -10.04% |

| Total Fees | $508.5k | -46.72% |

LlamaLend Performance

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $44.57M | +1.77% |

| Supplied | $35.77M | +0.58% |

| Borrowed | $25.61M | +0.89% |

| Loans | 594 | +22 |

Notable Pool Activity

Highest Volume Pools

Notably the Curve.fi Strategic USD Reserve pool made the list of highest volume pools with only a very small fraction of the TVL compared to other pools, this pool is also featured in the Recently launched pools below.

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$464.8M | $164.3M |

|

ETH ETH stETH stETH |

$329.3M | $137.9M |

|

USDe USDe USDC USDC |

$159.3M | $10.22M |

|

USDC USDC USDT USDT |

$93.97M | $5.778M |

Recently Launched Pools

| Chain | Pool | TVL |

|---|---|---|

|

USDC USDC USDT USDT |

$5.778M |

|

frxUSD frxUSD sUSDS sUSDS |

$2.094M |

Highest Fee Generating Pools

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$46.48k | $464.8M |

|

USDT USDT WBTC WBTC WETH WETH |

$42.96k | $40.38M |

|

USDT USDT WBTC WBTC WETH WETH |

$32.98k | $78.85M |

|

ETH ETH stETH stETH |

$32.93k | $329.3M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.