Curve Best Yields & Key Metrics | Week 9, 2025

Weekly yield and Curve ecosystem metric updates as of the 27th February, 2025

Market Overview

Crypto markets took a hit this week, but Curve held stronger than most. Its TVL dropped to $1.896B—just 8.1% down compared to the average 14.5% drop across other protocols.

This dip has actually opened up some amazing opportunities for liquidity providers. Several USD stablecoin pools are now offering returns above 100%!

This weekly update highlights the most compelling opportunities and metrics across the Curve ecosystem.

Be sure to catch our updates every Thursday moving forward for the latest insights!

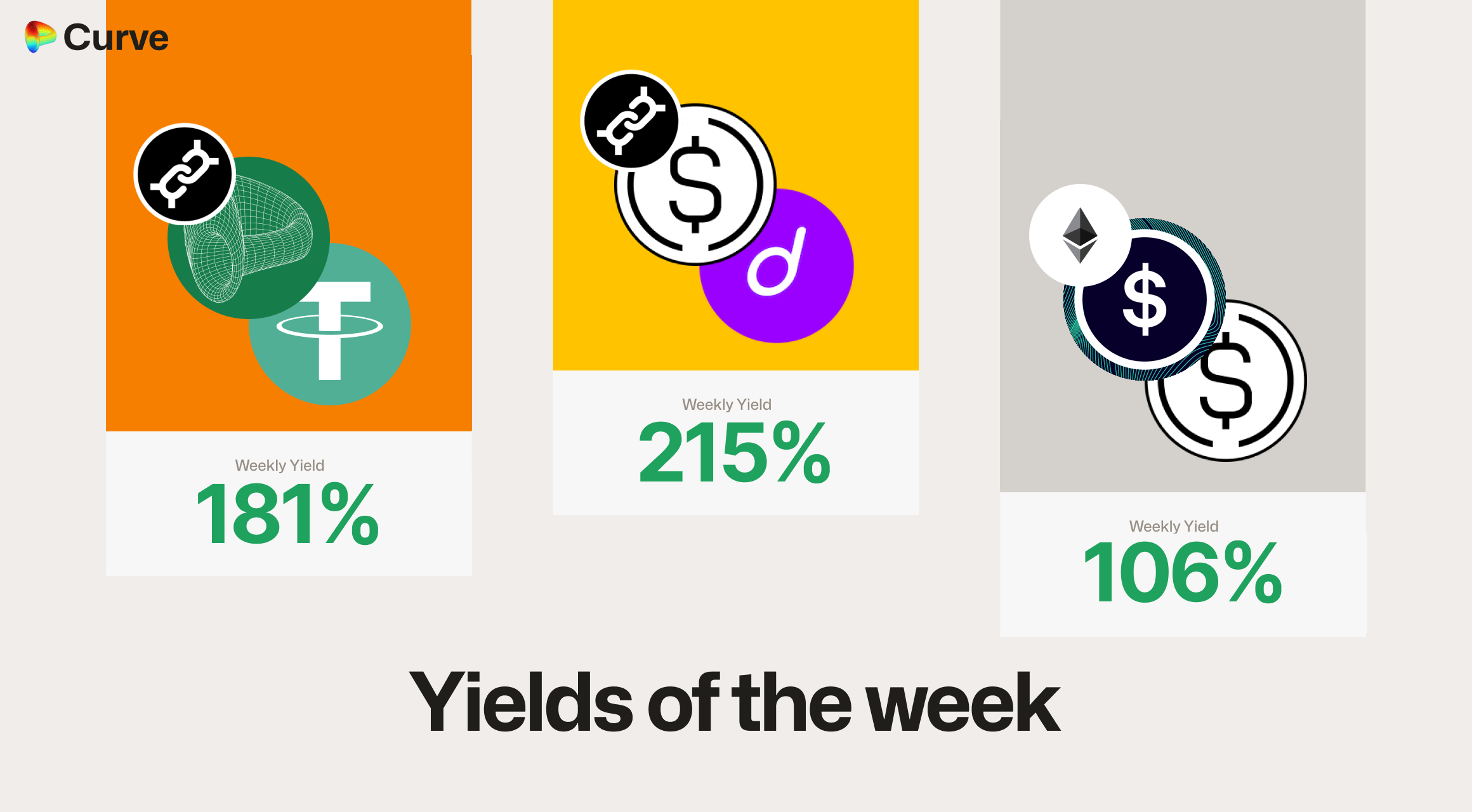

Top Yields

Top Performing Pools by Asset Class

| Chain | Pool | Type | Yield |

|---|---|---|---|

|

dUSD dUSD sUSDe sUSDe |

USD | 215.6% |

|

crvUSD crvUSD USDT USDT |

USD | 181.8% |

|

sUSD sUSD sUSDe sUSDe |

USD | 106.4% |

|

yUSD yUSD sDOLA sDOLA |

USD | 69.73% |

|

crvUSD crvUSD WBTC WBTC WETH WETH |

TRICRYPTO | 34.76% |

|

CRV CRV crvUSD crvUSD |

CRV | 30.87% |

|

CRV CRV vsdCRV vsdCRV asdCRV asdCRV |

CRV | 24.62% |

|

msETH  frxETH frxETH |

ETH | 24% |

|

ynETHx ynETHx WETH WETH |

ETH | 20.74% |

crvUSD & scrvUSD Yield Opportunities

| Chain | Market | Type | Yield |

|---|---|---|---|

|

crvUSD crvUSD USDT USDT |

Pool | 182.8% |

|

crvUSD crvUSD scrvUSD scrvUSD |

Pool | 26.77% |

|

crvUSD crvUSD USDT USDT |

Pool | 25.51% |

|

MIM MIM crvUSD crvUSD |

Pool | 24.88% |

|

crvUSD crvUSD USDC USDC |

Pool | 24.04% |

|

crvUSD crvUSD tBTC tBTC |

LlamaLend | 22.18% |

Ecosystem Metrics

All changes (shown with + or -) represent the difference compared to values from one week ago.

crvUSD & scrvUSD Performance

The crvUSD peg remains very strong, and the percentage of crvUSD staked as scrvUSD has stayed almost unchanged, despite the slight reduction in APY. This stability demonstrates that users feel comfortable holding scrvUSD even during market downturns.

| Metric | Value | Change |

|---|---|---|

crvUSD Circ. Supply crvUSD Circ. Supply |

$64.63M | -3.67% |

scrvUSD Yield scrvUSD Yield |

7.66% APY | -1.43% |

crvUSD in crvUSD in scrvUSD scrvUSD |

28.16% | -0.07% |

crvUSD Peg crvUSD Peg |

$1.00032 | +$0.00032 |

Avg. Borrow Rate Avg. Borrow Rate |

5.469% | -1.26% |

Loans Loans |

635 | -14 |

Fees Fees |

$74.59k | -26.94% |

Pegkeeper Debt Pegkeeper Debt |

$8.123M | +2.712M |

Pool Statistics

Volatility has proven excellent for volumes and fees. The average transaction value has almost doubled this week, reflecting increased trading activity during the market fluctuations.

| Metric | Value | Change |

|---|---|---|

| TVL | $1.741B | -8.13% |

| Volume | $3.652B | +96.57% |

| Transactions | 375,791 | +11.38% |

| Total Fees | $671.8k | +73.90% |

LlamaLend Performance

Unfortunately, the recent market downturn has prompted some larger borrowers to close their loans, reducing the overall LlamaLend TVL.

| Metric | Value | Change |

|---|---|---|

| Lending TVL | $39.87M | -12.62% |

| Supplied | $33.59M | -8.40% |

| Borrowed | $21.89M | -37.01% |

| Loans | 591 | +2 |

Notable Pool Activity

Highest Volume Pools

| Chain | Pool | Volume | TVL |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$824.1M | $162.4M |

|

ETH ETH stETH stETH |

$580.3M | $119.8M |

|

USDe USDe USDC USDC |

$326.9M | $9.942M |

Recently Launched Pools

Five notable pools launched this week, with a combined TVL of over $4M!

| Chain | Pool | TVL |

|---|---|---|

|

ynETH ynETH ynLSDe ynLSDe |

$3.235M |

|

sfrxUSD sfrxUSD scrvUSD scrvUSD |

$523.9k |

|

frxUSD frxUSD scrvUSD scrvUSD |

$196k |

|

sUSD sUSD sUSDe sUSDe |

$57.64k |

|

crvUSD crvUSD USDT USDT |

$31.61k |

Highest Fee Generating Pools

The 3pool once again generated the most fees across the platform. Following the recent governance vote, 100% of these fees now flow directly to the CurveDAO—a notable difference from standard pools where only 50% of generated fees are directed to the CurveDAO.

| Chain | Pool | Fees | Volume |

|---|---|---|---|

|

DAI DAI USDC USDC USDT USDT |

$84.08k | $824.1M |

|

ETH ETH stETH stETH |

$58.04k | $580.3M |

|

USDT USDT WBTC WBTC WETH WETH |

$38.5k | $19.29M |

Curve's ecosystem continues to expand rapidly, welcoming new teams and pools weekly. If you're interested in launching a pool, lending market, or simply want to connect with the community, join us on Telegram or Discord.

Risk Disclaimer

References to specific pools or Llamalend markets do not constitute endorsements of their safety. We strongly encourage conducting personal risk analysis before engaging with any pools or markets. Please review our detailed risk disclaimers: Pool Risk Disclaimer, Llamalend Risk Disclaimer, crvUSD Risk Disclaimer.