Curve Monthly Recap April, 2025

Curve Monthly Recap of key developments, milestones and ecosystem updates for April, 2025

Welcome to this month’s Curve Finance recap. In this regular update, we highlight the key developments, milestones, and ecosystem updates that shaped the past month. Each edition offers a clear and transparent view into Curve’s ongoing progress within the broader DeFi landscape.

Key moments in April:

- Curve's TVL increased to over $2B

- USDC/USDT Strategic Reserves pool was added as a Basepool, allowing anyone to create a pool and access both USDT & USDC liquidity efficiently.

- The Resupply project, launched in mid-March, reached $100 million in borrowed reUSD, increasing demand for crvUSD, and boosting borrowing and lending activity on Curve's Llamalend.

- OP rewards went live for Optimism's Llamalend & select crvUSD pools

Curve TVL Surpasses $2B

Curve’s total value locked (TVL) has risen above $2 billion once again, driven by consistent growth across its core products: liquidity pools, LlamaLend, and crvUSD.

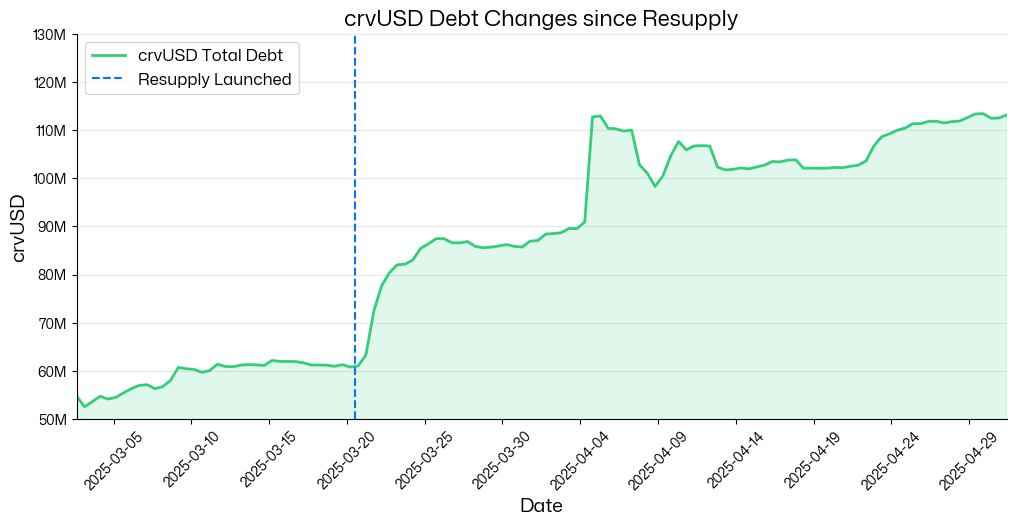

CrvUSD Growth

crvUSD debt has been rising steadily, driven by strong demand from Resupply and supported by PegKeepers and scrvUSD dynamics maintaining a tight peg and lowering borrowing rates across the board.

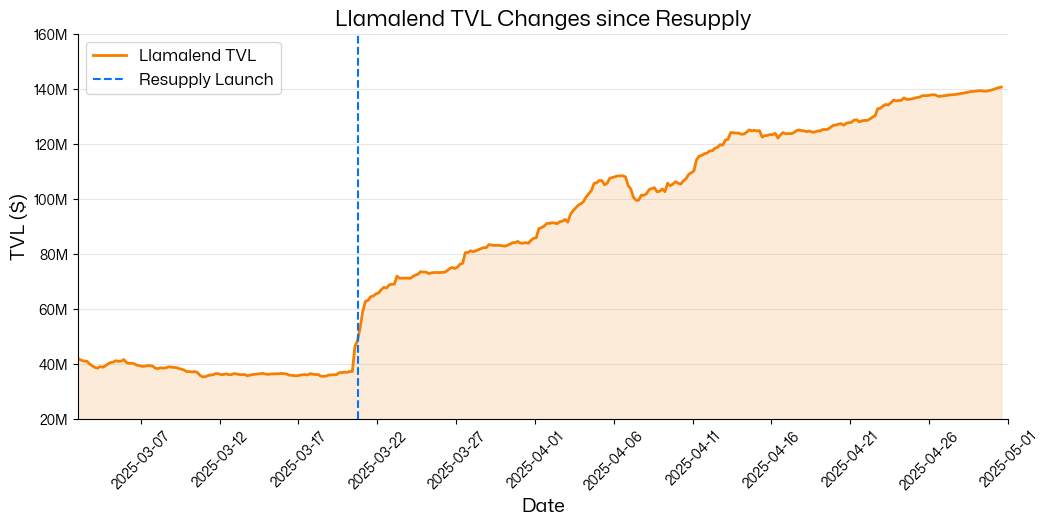

LlamaLend Growth

Llamalend has seen a significant boost in TVL thanks to increased collateral supply driven by Resupply. When reUSD borrowers deposit collateral, that liquidity becomes available in Llamalend markets. As a result, more borrowers are tapping into the platform’s deep liquidity and competitive rates. See the TVL changes below:

USDC/USDT Strategic Reserves added as a Basepool

A new set of experimental pools—with tightly concentrated liquidity and an aggressive fee ramp when deviating from equilibrium—have seen strong utilization since launch. Based on this success, USDC/USDT Strategic reserves pool has now been voted to be a Basepool, further expanding Curve’s stablecoin infrastructure.

As a Basepool, USDC/USDT can now be used in Metapool constructions, enabling seamless integration without requiring protocols or users to choose between USDT and USDC.

See below for the full news article:

Integrations & Ecosystem

Resupply's reUSD Grows to $100M

Resupply’s stablecoin, reUSD, which is backed by crvUSD deposits in Llamalend and frxUSD in Frax Lend. The new liquidity positively increased ’s lending metrics, increasing TVL and reducing average borrowing rates. This has also increased borrowing across all Llamalend markets.

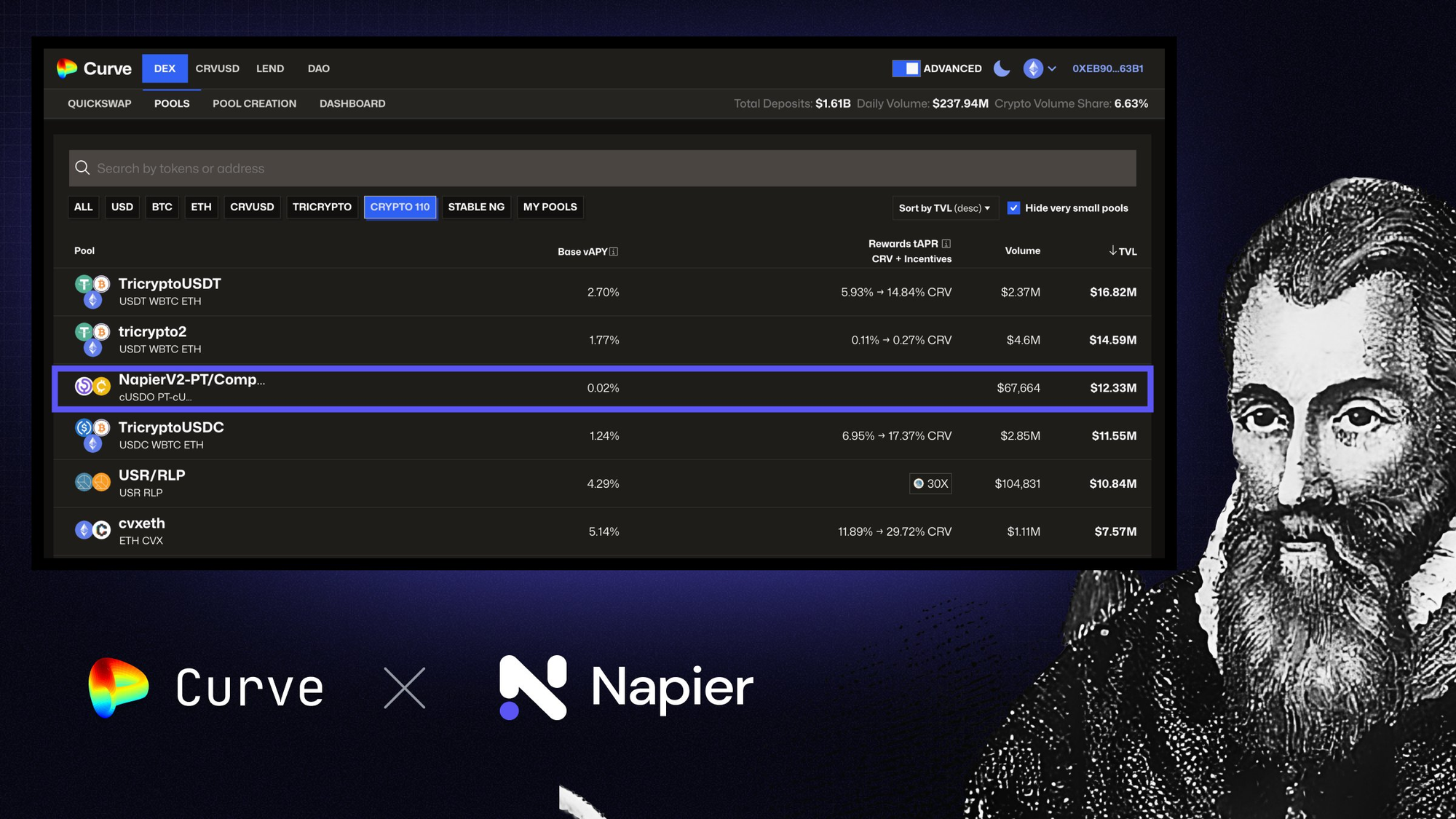

Napier Finance Grows from $9M -> $42M in April

Napier Finance, a new protocol directly leveraging Curve’s pool infrastructure—similar in design to Pendle and Spectra (also built on Curve)—launched its second version in March. The upgrade has already begun attracting strong interest, and growing from $9M to $42M million in TVL in April alone. It's exciting to see continued innovation built on Curve.

EYWA's CrossCurve Begins Deployment to Sonic

EYWA's CrossCurve has begun it's migration from Fantom to Sonic. CrossCurve is built to allow cross chain swaps directly through Curve pools and contributes to over $5M of TVL on Curve. Their migration requires whitelisting many new pools for CRV emissions, and has created some great opportunities for yield.

Guess who’s created new pools on @SonicLabs and kicked off migration prep? 👀

— EYWA ✳️ powering CrossCurve ➡️ TOKEN2049 (@eywaprotocol) April 22, 2025

That’s right — we did.@CurveFinance vote is live to get these pools whitelisted. Let’s go! https://t.co/Lk41q0rGKY

Deployments

Curve Integrates with Plasma (Tether Chain)

Curve is partnering with the Plasma Foundation (Tether chain) to launch stablecoin swaps and yield opportunities on Plasma’s Bitcoin sidechain from day one. This integration brings Curve’s deep liquidity and crvUSD to Plasma’s low-cost, Bitcoin-settled infrastructure—enabling efficient swaps and expanding DeFi access for Bitcoin users.

The gold standard for stablecoin swaps is coming to Plasma.

— Plasma (@PlasmaFDN) April 21, 2025

Swap with precision. Earn with efficiency.

Today, we’re excited to announce our next major ecosystem partner: @CurveFinance. pic.twitter.com/IyHJYag96n

OP Rewards for Optimism Llamalend & Select crvUSD Pools

The Curve DAO passed a governance proposal to allocate 60,000 $OP (received from a previous grant from Optimism) from its Vault to bootstrap LlamaLend markets & selected crvUSD pools on Optimism. This initiative aimed to kickstart lending activity and enhance crvUSD liquidity across key collateral markets.

Notable Articles & Research

- Yield Basis: the next BTC Liquidity Blackhole - Vasily Sumanov's article informs about Yield Basis – a project of Curve's founder Michael Egorov, which uses BTC and ETH collateral to borrow crvUSD from Curve and deposits into it's own novel AMM

- Flaws in stablecoin development and Curve Finance - Karl Marx OnChain highlights Curve Finance's pivotal role in stablecoin infrastructure, emphasizing its record-breaking $35B trading volume in Q1 2025 and the transparent, on-chain collateral mechanism of $crvUSD amidst a surging stablecoin market projected to exceed $300B by 2026.

- LlamaLend IRMs: Comparative Analysis - LlamaRisk published research about opportunities to improve LlamaLend interest rate markets (IRMs), through an analysis of monetary policies.

- Buyback and burn was compared to ve-tokenomics for Curve, results below:

Research on why ve-tokenomics is better than buy-and-burn model.

— Curve Finance (@CurveFinance) April 28, 2025

In brief: ve-tokenomics is around 3 times better even if bribes are included in considerationhttps://t.co/wtBxyl32AZ pic.twitter.com/J7iQYTjDoZ

Conclusion

April 2025 was an active month for Curve Finance, with much of the progress happening behind the scenes—expanding lending markets, launching new partner integrations, refining the interface, and building next-generation DEX pools designed to boost trading efficiency.

These developments reinforce Curve’s role as a core pillar of DeFi and a major hub for the expanding universe of stablecoins, which continues to surpass all-time highs in supply.

Stay tuned for more updates.