Curve Finance observes Revenue Growth post US Elections

The period following Donald Trump's recent U.S. election victory has been highly profitable for the cryptocurrency industry. Key stocks like $MSTR and $COIN have been re-evaluated, and Bitcoin ($BTC) is nearing the $100,000 mark.

There has been an increasing demand for leverage, with the 7-day moving average of crvUSD markets heading towards 25%.

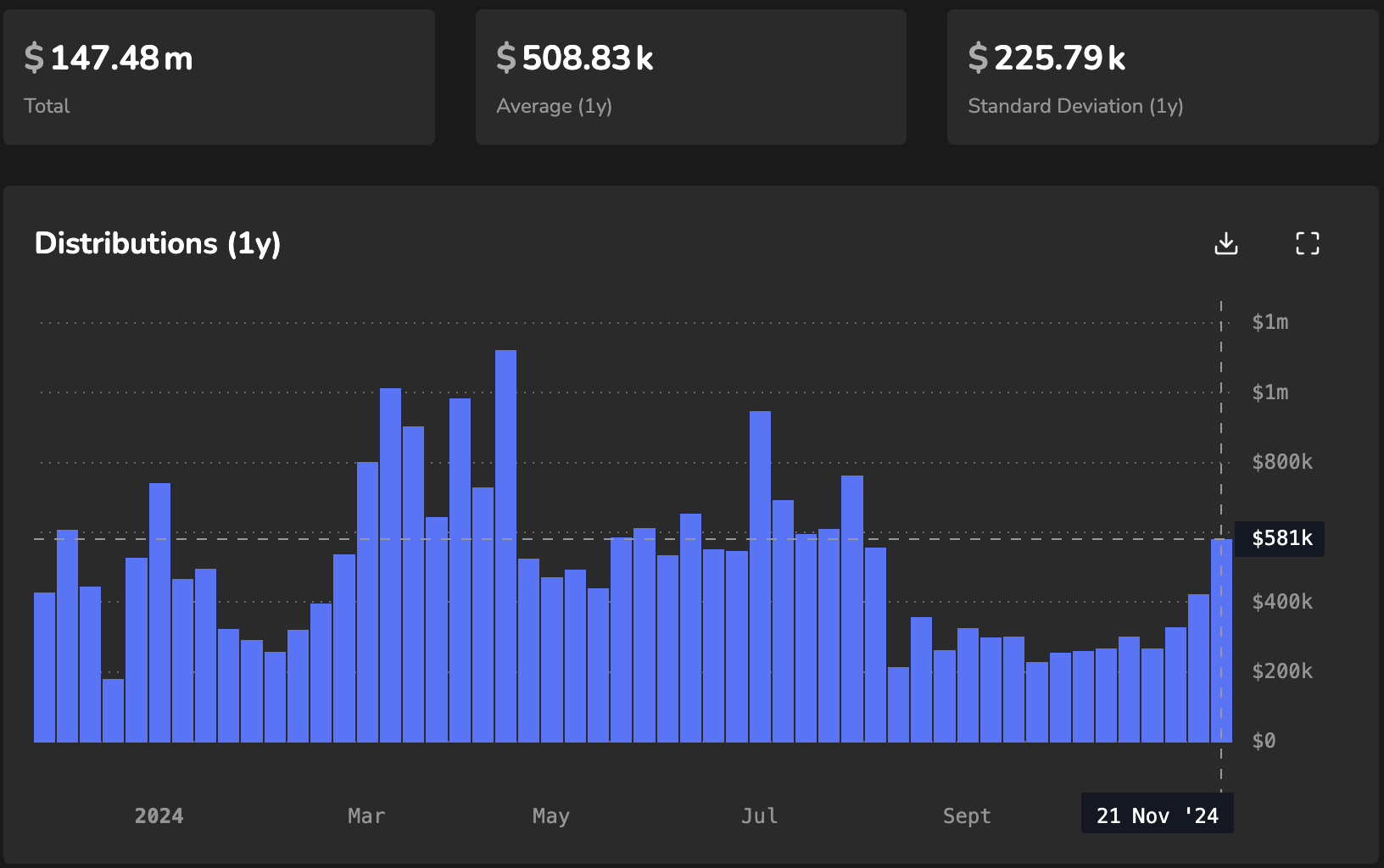

The demand in leverage has resulted in an increase in revenue that the DAO earns on a weekly basis, with weekly revenues rising from a pre-Trumpian average of USD 268k, now eclipsed by USD 581k in the past week. The current annualised revenue that is distributed to CurveDAO’s stakeholders (veCRV) is approximately USD 31 million per year, not accounting for revenues from incentives for participating in gauge votes.

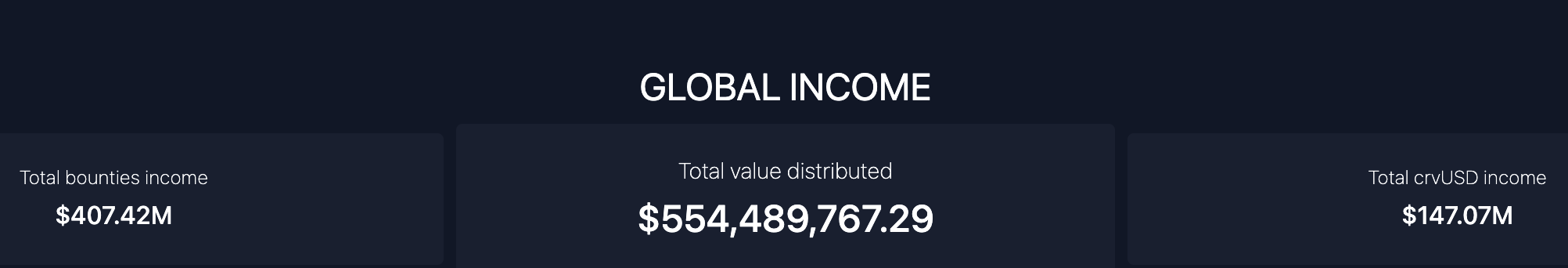

As of today, including vote incentive bounties, the DAO has earned a total of USD 554 million.

The high interest rates hinder new borrows. To combat this lack of growth in new borrowers, CurveDAO launched the Savings crvUSD product, leading to an inflow of approximately USD 9 million of liquidity by savings-seekers. With newer integrations such as fixed-income in collaboration with Spectra Finance (which uses Curve CryptoSwap market-making algorithm underneath) in the pipeline, CurveDAO aims to provide more products in the safe and fixed yield product line in the future.

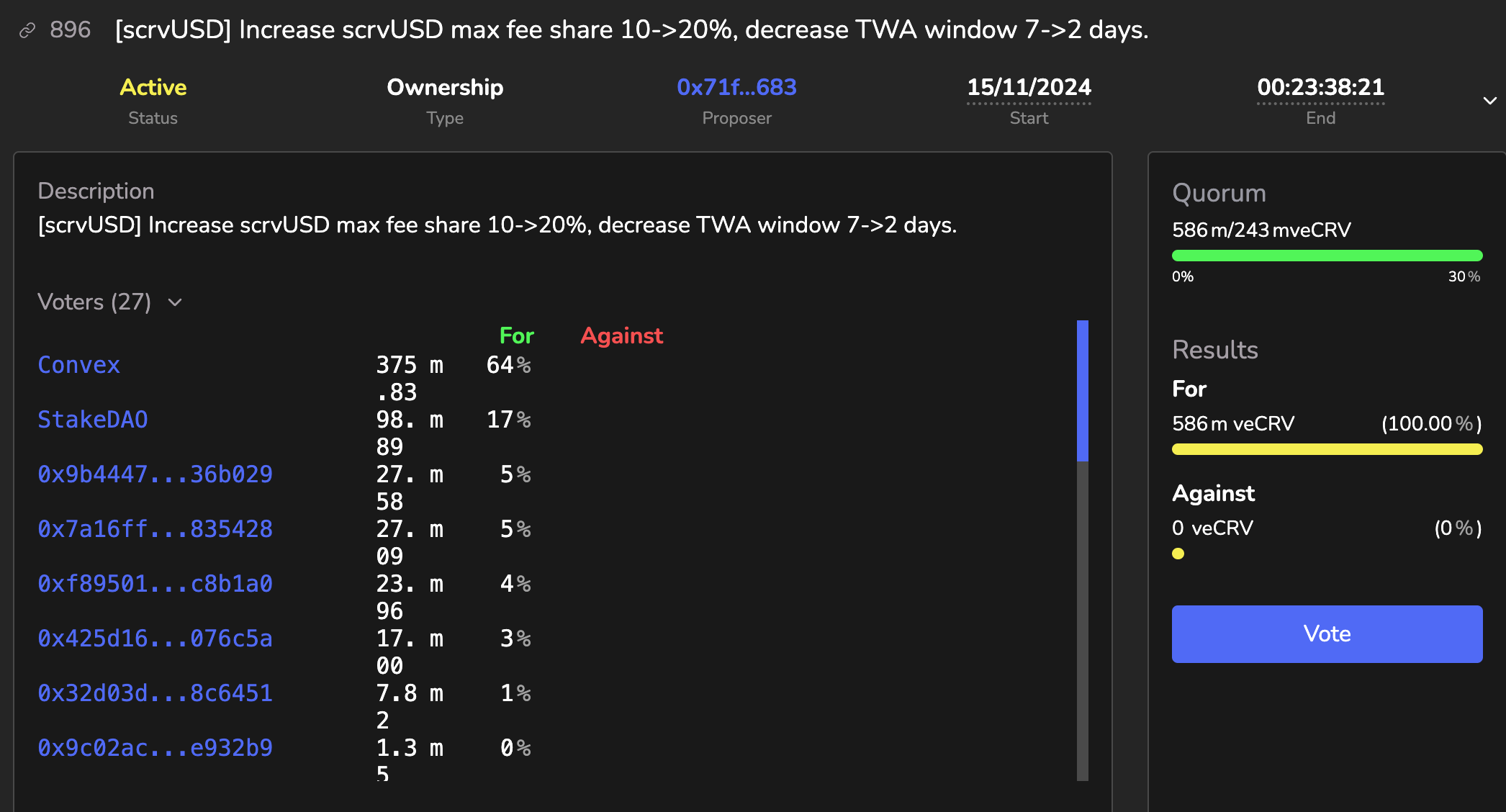

The growth of revenue is welcomed, as CurveDAO is poised to increase the fraction of revenue funneled into the Savings Product from the 22nd of November 2024, following the DAO proposal on Curve’s Governance Hub. The DAO is set to increase the revenue share to scrvUSD holders from 10% of earned revenue to a cap of 20%, and enhance the reactivity of the crvUSD yield-rate to the market’s needs.

The DAO on-chain vote is unanimous, with 586m veCRV voting in-favor of the proposal.

The changes proposed to the scrvUSD yield rates as well as the growth in revenue for the DAO is set to attract significantly more demand and help lower interest rates, allowing the DAO to sustainably scale the LlamaLend product.