Introducing Savings crvUSD (scrvUSD)

CurveDAO launches Savings crvUSD (scrvUSD), a yield-bearing version of its stablecoin, enabling users to earn "low-risk" autocompounding interest on their crvUSD deposits.

CurveDAO, the leading decentralized exchange (DEX) for equivalent asset trading, creator of the LLAMMA liquidation-protection algorithm and crvUSD stablecoin, has launched Savings crvUSD (scrvUSD). This new savings module is set to be the engine for scaling crvUSD, the stablecoin issued by Curve, enabling market participants to engage directly with its monetary policy. Developed in partnership with Yearn Finance and utilizing Yearn's custom V3 Vaults, scrvUSD offers users a yield-bearing, interest-earning stablecoin.

crvUSD

Curve’s stablecoin, crvUSD, is designed as a decentralized, overcollateralized asset, protected by the LLAMMA algorithm, which minimizes the risk of liquidations. This unique design stabilizes borrowing and lending, offering a safer, more resilient asset for users. Users can either mint crvUSD by securing it with supported collateral or acquire it directly through exchanges, with the most liquid markets available on Curve itself.

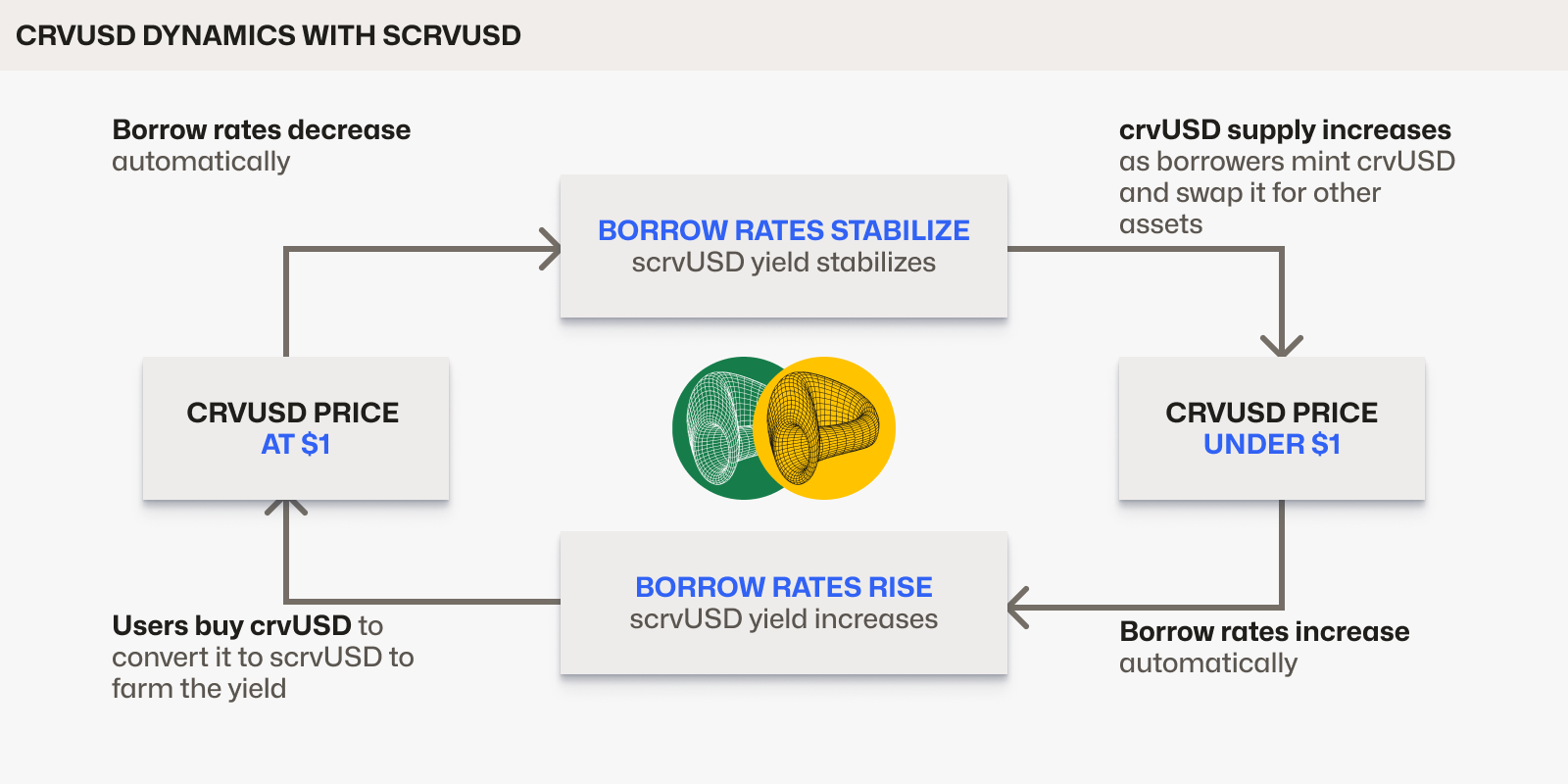

Interest rates for crvUSD respond dynamically to its dollar peg: rates rise sharply if crvUSD dips below $1 and drop when it trades above $1. This mechanism has made crvUSD attractive for borrowers, though high sustained interest rates in the past limited new borrowing activity, affecting the stablecoin's scalability.

Introducing scrvUSD

The introduction of scrvUSD as an interest-bearing stablecoin addresses this by providing low-risk yields derived from a portion of the interest paid by crvUSD minters. This yield is managed on-chain by CurveDAO, which effectively acts as a decentralized, on-chain central bank offering “low-risk” returns. User funds in the scrvUSD module are not re-hypothecated, and all collateral remains fully on-chain, making it a secure choice compared to other popular stablecoins. Both crvUSD and scrvUSD smart contracts are audited by leading industry firms such as Chainsecurity, Statemind, and Peckshield, with an immutable design ensuring composability and reliability.

As an autocompounding, interest-bearing stablecoin, scrvUSD holds value beyond just stable transactions; it can be deployed across the broader DeFi ecosystem, from lending protocols to liquidity pools and trading platforms. This opens new avenues for composability, allowing users to leverage scrvUSD in multiple ways across DeFi, enhancing crvUSD’s utility and value in other applications.

Improved crvUSD dynamics and attractiveness

Users interested in these low-risk yields can acquire crvUSD on the market and deposit it into Savings scrvUSD. As deposits flow in the vault, crvUSD’s peg is stabilized, crvUSD’s borrowing rates are lowered, and new borrowers are attracted to Curve’s Llamalend platform. As more borrowers mint and use crvUSD, this demand increases the total value locked (TVL) and creates higher “low-risk” yields, incentivizing further lending to the protocol. This cycle, or “crvUSD flywheel,” directly scales the stablecoin’s use and stability.

A new DeFi primitive?

With Savings crvUSD introduces a interest bearing stablecoin, offering a decentralised alternative to other interest-bearing stablecoins like sDAI, sUSDe and others. With this new product, CurveDAO solidifies its role in DeFi, continuing to drive decentralisation, innovation, security, and scalability in stablecoin markets.

Start saving with crvUSD: https://crvusd.curve.fi/#/ethereum/scrvUSD

Learn More

Read more about scrvUSD here: https://resources.curve.fi/crvusd/scrvusd/

Develop on top of scrvUSD here: https://docs.curve.fi/scrvusd/overview/