scrvUSD gets its first yield market on Spectra

A new scrvUSD yield-trading liquidity pool with a May 15th 2025 maturity launched on Spectra Finance, providing new yield opportunities for scrvUSD holders. Spectra’s DAO aims to onboard the liquidity pool to it’s veAPW gauge system (Spectra Gov Proposal) and offer further incentives to liquidity providers underwriting yield swaps.

About Spectra Finance

Spectra is a permissionless protocol designed to create yield markets, aiming to revolutionize interest rate trading in DeFi. By enabling users to trade floating rates against fixed rates, Spectra offers new avenues for generating yields on scrvUSD.

Spectra uses Curve’s Cryptoswap AMM algorithm, where CurveDAO earns 50% of all fees generated by liquidity pools on Spectra. Spectra is an example of Curve’s AMMs being utilized in the yield-trading ecosystem, a part of DeFi popularized by Pendle.

How does Spectra increase scrvUSD’s adoption?

By introducing a yield market for scrvUSD, Spectra creates yet another avenue for Curve’s yield-bearing stablecoins. It opens the token to more use cases by allowing users to speculate on scrvUSD yields, capturing profits by:

- Expecting an Increase in scrvUSD yields: If crvUSD borrowing behavior suggests that the yield on scrvUSD will go up, purchasing YTs can be advantageous. YTs are linked to the floating interest rate, so their returns increase with rising rates.

Example: Suppose the current yield on scrvUSD is 12%, and demand for leverage goes up; Curve’s crvUSD stablecoin generates more revenues, which means scrvUSD yields rise to 15%. Buying YTs now means benefiting from the higher future rate. - Hedging Against Fixed Rates: If there's uncertainty about future rates and a possibility they might exceed current fixed rates, acquiring YTs provides exposure to potential increases.

How to generate yields on scrvUSD through Spectra:

- Provide Liquidity in Spectra Pools: Liquidity can be supplied to pools consisting of an interest-bearing token (iBT) and a principal token (PT).

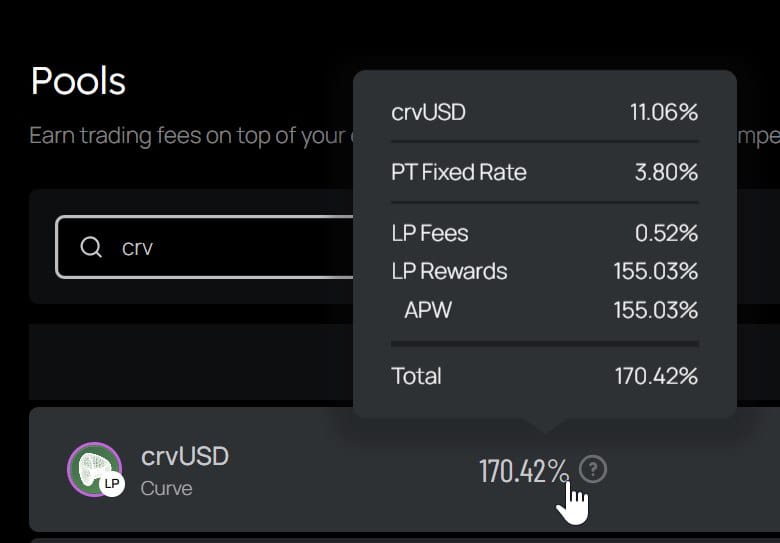

- Earn trading fees in Spectra Pools: Liquidity providers earn fees from swaps within the pool and continue to receive the native scrvUSD yield while holding fixed-rate PTs.

- Get additional Incentives: Pools may receive additional rewards approved by the Spectra DAO, enhancing the annual percentage yield (APY) for liquidity providers. Additional boosts are available for those participating in veLock.

- Purchase Principal Tokens (PTs): PTs can be bought to lock in fixed yields on scrvUSD with a maturity date of May 14, 2025. This secures a known return over the period, providing a hedge against interest rate changes.

- Trade Between Floating and Fixed Rates: Engaging in trades between floating-rate yield tokens (YTs) and fixed-rate PTs allows for speculation or hedging based on interest rate expectations, offering opportunities to benefit from changes in scrvUSD yields.

Note: for more information on how PT & YT tokens work, see Spectra's documentation here: Spectra: Principal & Yield Tokens

Risks and Considerations:

- Yield Rate Fluctuations: The main risk involves changes in yield rates. Exchanging higher-yielding PTs for lower-yielding iBTs when scrvUSD yields decrease may result in lower returns. Conversely, if yields increase, higher returns are possible.

- Liquidity Constraints: Being the only liquidity provider may limit the ability to exit before maturity. Additional liquidity from others increases flexibility for early exits.

- Impermanent Loss: Spectra pools have negligible impermanent loss during the term and none at maturity because PTs are redeemed 1:1 for crvUSD.

By participating in these opportunities, more crvUSD can be accumulated until the maturity date in May, optimizing DeFi yield strategies through Spectra's platform.

Spectra further decentralizes Curve

Curve’s ecosystem consists of several protocols that have found success building on top of Curve’s Infra. Industry heavyweights such as Convex, StakeDAO, Yearn, CrossCurve (by EYWA), Gearbox, and many more. Spectra’s success has a direct impact on Curve’s success, and meets CurveDAO core values of decentralizing it’s protocol.